Decentralized finance (DeFi) has always promised a future of open, borderless financial systems. Yet, as adoption accelerates in 2025, the tension between privacy and transparency has never been more acute. Users and institutions demand confidentiality for sensitive financial data, but regulators and protocols require verifiability and auditability. Enter confidential transactions: a breakthrough that is redefining on-chain privacy without eroding the foundational transparency of blockchain.

What Are Confidential Transactions in DeFi?

Confidential transactions refer to cryptographic methods that conceal crucial transaction details, such as sender, recipient, and amount, while still enabling the network to verify their legitimacy. Unlike traditional public blockchains where every detail is visible to all, confidential transactions use advanced cryptography to protect user data from prying eyes. This evolution is pivotal for DeFi’s next phase: institutional capital inflows, regulatory compliance, and mainstream adoption.

The most prominent cryptographic foundation for these systems is zero-knowledge proofs (ZKPs). ZKPs allow one party to prove a statement’s truth without revealing any underlying information. In practical terms, ZKPs can confirm that a transaction is valid, say, that Alice has enough tokens to send Bob an amount, without exposing either party’s balance or the actual transfer value.

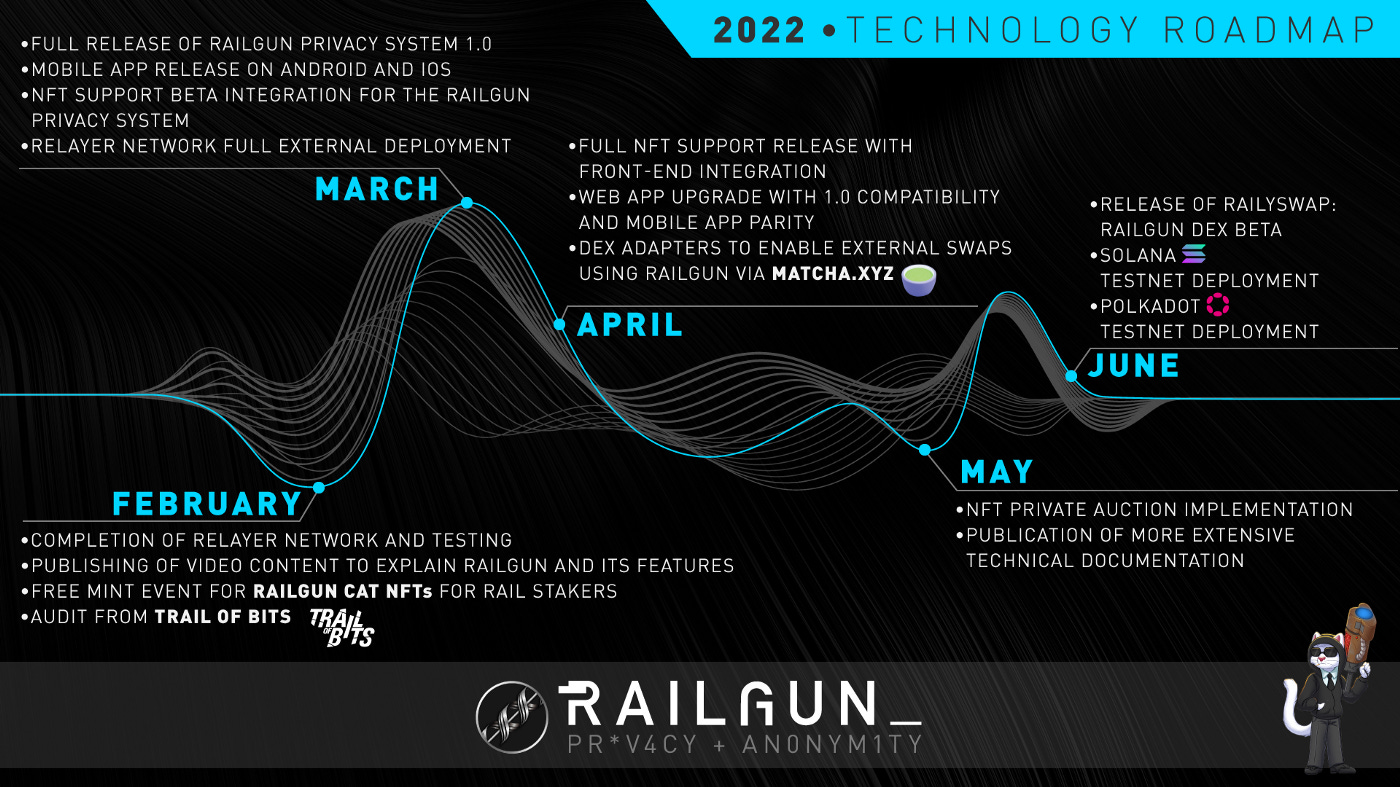

Recent innovations like encrypted smart contracts and privacy-preserving rollups have made it possible for DeFi platforms to offer this level of confidentiality at scale. For example, projects such as Railgun are leveraging next-generation ZKP technology so any on-chain contract can shield senders, recipients, and amounts. Meanwhile, Secret Network uses encrypted smart contracts as its core privacy mechanism.

The Technology Powering On-Chain Privacy

The rapid progress in confidential DeFi protocols hinges on a few key technological pillars:

- Zero-Knowledge Proofs (ZKPs): As outlined above, ZKPs are the backbone of modern privacy solutions in DeFi. Protocols like zk-Agreements combine ZKPs with smart contracts so agreement terms remain private but enforceable by code.

- Confidential Smart Contracts: Platforms such as Chainlink Confidential Compute enable smart contracts to execute encrypted computations on any blockchain. Trusted Execution Environments (TEEs) and Fully Homomorphic Encryption (FHE) further enhance these capabilities by keeping both logic and data private during execution.

- Privacy-Preserving Rollups: Layer 2 solutions like Calyx introduce multi-token optimistic rollups with full payment privacy, no sender/recipient/amount/token type data is revealed on-chain. This ensures scalability without compromising confidentiality or efficiency.

This new class of on-chain privacy solutions empowers developers to build applications where user data remains shielded even as the system remains auditable by external parties, a true balance between privacy and transparency in blockchain.

Why Privacy Matters: Institutional Adoption and Regulatory Compliance

The integration of confidential transactions isn’t just about individual users hiding their balances; it’s increasingly critical for enterprises and institutional players entering DeFi. Stealth addresses combined with ZKPs now allow capital managers to comply with regulations like GDPR while maintaining operational secrecy, a requirement for handling sensitive financial flows at scale.

This dual assurance, privacy for users and compliance-ready transparency for regulators, is catalyzing a new wave of adoption. As highlighted by recent projects launching programmable privacy features, organizations can now customize their confidentiality settings via smart contracts just like any other blockchain function. This trend signals a future where privacy becomes modular infrastructure rather than an afterthought or add-on feature.

The Trade-offs: What Breaks When DeFi Goes Private?

No innovation comes without trade-offs. While private DeFi promises full confidentiality, even within complex contract logic, it also introduces new challenges around composability, liquidity discovery, and MEV resistance. As protocols race ahead with features like end-to-end encrypted smart contracts (see implementation guides here), developers must carefully balance usability with security guarantees.

Despite these challenges, the direction is clear: confidential transactions are shaping DeFi’s future by enabling privacy without undermining the verifiability that underpins trust in decentralized systems. Recent deployments of confidential DeFi protocols show that it’s possible to have user-level privacy while maintaining auditable system-wide integrity. For example, projects like Railgun and Secret Network demonstrate that encrypted smart contracts can facilitate private swaps, lending, and governance, without leaking sensitive data to competitors or external observers.

Top Confidential DeFi Protocols & Their Unique Privacy Features (2025)

-

Railgun: Leverages next-generation zero-knowledge proof technology to shield sender, recipient, and transaction amounts in any on-chain DeFi contract. Railgun enables full privacy for swaps, lending, and other DeFi actions while remaining compatible with popular blockchains.

-

Secret Network: Pioneers encrypted smart contracts (Secret Contracts) that keep transaction logic and data confidential. Secret Network supports DeFi, NFTs, and DAOs with built-in privacy and cross-chain interoperability via Cosmos IBC.

-

Chainlink Confidential Compute: Introduces private smart contract execution using confidential computing, allowing sensitive data to be processed securely on any blockchain. This service empowers DeFi protocols to offer privacy-preserving features without sacrificing transparency or auditability.

-

Aleo: Implements privacy-by-default for all transactions using advanced zero-knowledge cryptography. Aleo ensures that sender, receiver, and amount are encrypted, enabling private DeFi applications and programmable privacy for users and developers.

-

Calyx: Deploys a privacy-preserving multi-token optimistic rollup protocol as a Layer 2 solution. Calyx guarantees that all Layer 2 transactions remain fully confidential—including sender, recipient, amount, and token type—while maintaining high scalability and efficiency.

-

Zama Confidential Blockchain Protocol: Supports end-to-end encrypted smart contracts and composability, enabling private DeFi, NFTs, and DAO governance. Zama’s protocol is designed for institutional-grade confidentiality and regulatory compliance.

-

DarkFi: Focuses on full confidentiality for balances and actions within complex smart contracts. DarkFi’s architecture is built to ensure that all DeFi operations are private by default, appealing to users seeking maximum secrecy.

Moreover, innovations in secure oracles and confidential computing are closing the gap between on-chain and off-chain data privacy. Chainlink Confidential Compute is a notable advancement, enabling smart contracts to access private data feeds securely, crucial for enterprise DeFi use cases where proprietary information must remain confidential even as it drives automated outcomes.

Composability and Cross-Chain Confidentiality

An emerging trend in 2025 is the push for cross-chain privacy. With full Cosmos IBC support now available for several privacy-focused networks, DeFi users can maintain confidentiality not just within one protocol but across multiple blockchains. This unlocks new composable applications: imagine a private loan on one chain being collateralized by assets on another, all without exposing transaction details at any step.

This cross-chain confidentiality is also powering new forms of DAO governance and NFT trading where voting weights or asset ownership can be hidden from public view but still verifiable by auditors or smart contracts. As a result, we’re seeing a shift toward privacy-as-infrastructure, where confidentiality becomes a default expectation rather than an advanced feature.

Balancing Privacy With Transparency: The Path Forward

The real breakthrough of confidential transactions in DeFi isn’t just technical; it’s philosophical. By leveraging zero-knowledge proofs, encrypted smart contracts, and privacy-preserving rollups, these protocols offer a middle ground between absolute secrecy and radical transparency. This balance reassures regulators and institutional investors while empowering individuals to control their own financial data.

For developers seeking practical guidance on deploying these solutions securely, and maximizing both compliance and user trust, resources like our in-depth guide on private verifiable DeFi contracts are invaluable starting points.

Looking Ahead: Confidential Transactions as Standard Practice

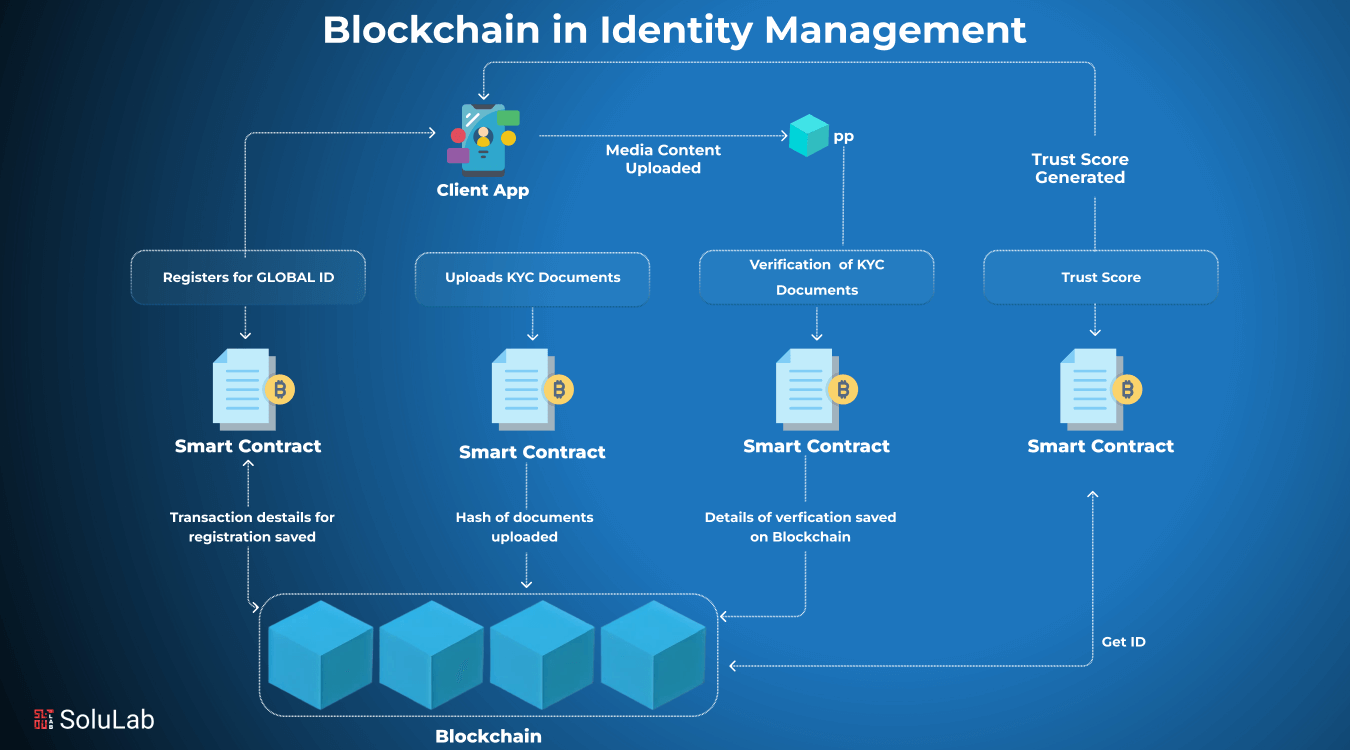

As privacy coins continue evolving alongside mainstream DeFi protocols, expect to see confidential transactions become standard practice across lending markets, DEXs, DAOs, and beyond. End-to-end encrypted smart contracts will underpin not just financial transfers but entire business logic flows, from payroll automation to identity management.

The next wave of adoption will hinge on making these tools accessible without sacrificing performance or composability. Projects like Calyx are already demonstrating that payment privacy at scale is possible through innovative Layer 2 designs. Meanwhile, programmable privacy lets organizations tailor confidentiality settings to their risk profile or jurisdictional requirements.

The bottom line: confidential transactions empower both individuals and institutions, offering true financial sovereignty without abandoning accountability. As technology matures and standards crystallize around encrypted smart contracts for DeFi privacy, we’re witnessing the blueprint for finance that is both open and untraceably secure, a paradigm shift whose impact will be felt far beyond crypto’s borders.