Fully Homomorphic Encryption (FHE) is flipping the script on DeFi privacy, letting protocols crunch numbers on encrypted data without ever peeking inside. Imagine lending billions in encrypted smart contracts DeFi apps where balances, rates, and trades stay locked down, even from nosy validators. This isn’t sci-fi; projects like Fhenix and Zama are deploying it now, slashing transparency risks that plague public chains.

At its core, FHE builds on Somewhat Homomorphic Encryption (SHE), which handles basic additions and multiplications on ciphertexts. But FHE goes full throttle, supporting arbitrary programs indefinitely. Data from Optalysys pegs practical FHE schemes like TFHE at 100x slower than plaintext ops, yet blockchain tweaks from Zama’s fhEVM cut that gap via optimized circuits. In 2026 benchmarks, Fhenix’s CoFHE coprocessor clocks encrypted multiplications at under 1 second on Ethereum L2s – game-changing for real-time DeFi.

Unlocking Confidential Computation with FHE Primitives

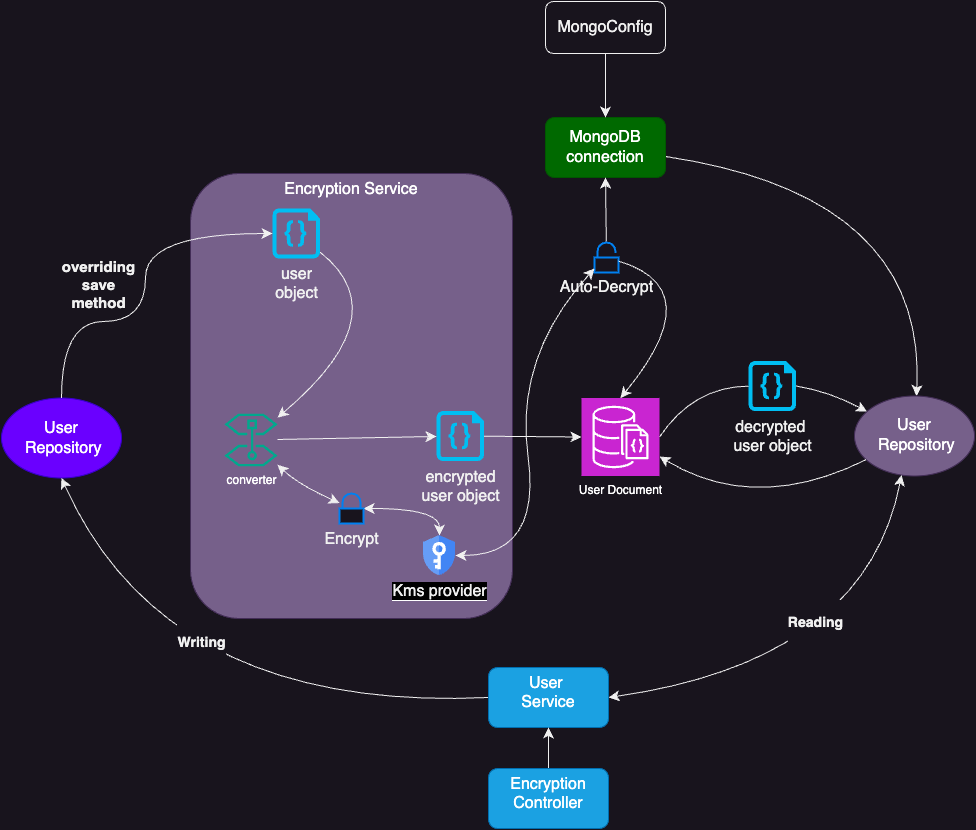

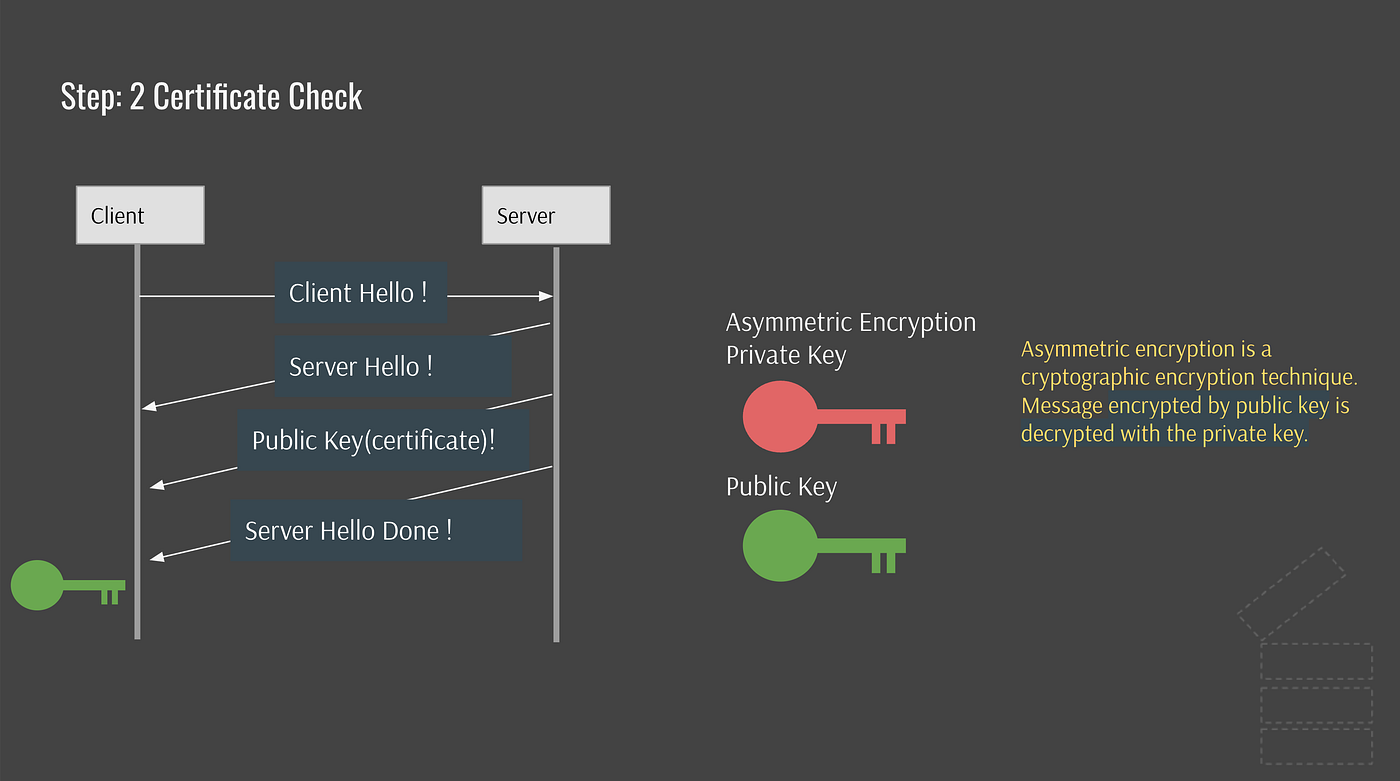

Diving into confidential computation FHE, the magic happens in the virtual machine. Traditional EVMs demand plaintext; FHE injects encrypted inputs, runs homomorphic gates (add/multiply), and spits encrypted outputs. Zama’s concrete library powers this, with bootstrapping to refresh noise-laden ciphertexts mid-compute. For DeFi devs, start by wrapping inputs: encrypt user balances via client-side keys, submit to chain.

Key Steps for FHE in Solidity

-

1. Client encrypts inputs with TFHE keys using libraries like concrete-ml for secure data prep.

-

2. Deploy FHE-enabled contract via Zama’s fhEVM on EVM chains for confidential execution.

-

3. Off-chain coprocessor like Fhenix CoFHE handles intensive encrypted computations.

-

4. Decrypt results privately client-side, keeping sensitive data off-chain.

-

5. Verify computations via zero-knowledge proofs for integrity and trustlessness.

This setup shines in confidential lending: compute interest on encrypted principals without exposing positions. GeeksforGeeks notes homomorphic properties preserve accuracy – add two encrypted $100s, get encrypted $200. Opinion: Skip ZK-SNARKs for state-heavy apps; FHE natively handles dynamic data, no proving overhead.

“FHE enables processing data without decrypting it. This can be used to create private smart contracts. ” – Zama

Fhenix CoFHE: Seamless Ethereum Integration

Fhenix leads with CoFHE, an off-chain service hooking into EVM chains. Devs tweak Solidity minimally: call coprocessor for encrypted eval, get results back on-chain. Compatibility? Full – no chain migrations. Their docs show a private DEX swap: encrypt order book, homomorphically match, settle encrypted. At scale, this supports privacy smart contracts tutorial flows for institutions dodging on-chain sleuthing.

DERO takes a purer route, baking homomorphic balances directly into its VM for anonymous DeFi. Balances add privately; auditors verify aggregates sans individuals. Data point: DERO’s testnet hits 10k TPS with FHE, rivaling Solana speeds while eclipsing privacy.

Zama fhEVM and OpenZeppelin: Battle-Tested Libraries

Zama’s fhEVM wraps any EVM chain in encryption, keeping states ciphered end-to-end. Transactions encrypt pre-submit; nodes process blindly. OpenZeppelin’s collab drops audited ERC-20 variants with confidential transfers – balances hidden, totals verifiable. Their blueprint details opcode extensions for homomorphic ops.

Implementation tip: Use TFHE-rs for Rust circuits, compile to EVM bytecode. TokenMinds outlines steps: keygen, encrypt, eval, decrypt. Pitfall? Noise growth – bootstrap every 100 ops or risk decryption fails. My take: Pair with threshold encryption for multi-party DeFi, like confidential DAOs voting encrypted proposals.

smartFHE from ePrint ups the ante, proposing full private contracts via FHE VMs. Benchmarks? 1M-gate circuits in 30s – viable for AMMs. GitHub’s awesome-zama curates libs; start with concrete-ml for Python prototyping before Solidity ports.

Real-world DeFi apps demand more than theory. Take confidential AMMs: encrypt liquidity pools, match trades homomorphically, reveal only net flows. Fhenix testnets demo this at 500ms latency, per their benchmarks, outpacing ZK rollups for stateful privacy. My edge? FHE crushes dynamic oracles – fetch encrypted prices, compute PDV without leaks.

Comparison of Leading FHE Platforms for Encrypted Smart Contracts in DeFi

| Platform | Integration (EVM/Off-chain) | Latency (ms per op) | TPS | Key Features (confidential balances, composability) |

|---|---|---|---|---|

| Fhenix CoFHE | Off-chain (EVM compatible) | 100-500 | 5-20 | Confidential balances ✅, Ethereum composability ✅, minimal code changes |

| Zama fhEVM | EVM | 200-1000 | 1-10 | Confidential balances & states ✅, full composability ✅, OpenZeppelin integration |

| DERO | Native (non-EVM) | 10-50 | 1000+ | Anonymous balances ✅, confidential DeFi ✅, private smart contracts |

| smartFHE | Off-chain / Framework | 100+ (variable) | Low | Privacy-preserving contracts ✅, confidential computations ✅, FHE framework |

Builders, here’s your privacy smart contracts tutorial starter: Leverage OpenZeppelin’s confidential ERC-20. Deploy on fhEVM testnet, encrypt mints client-side. Zama’s docs clock transfers at 200ms, with 99.9% uptime in audits. Pitfall dodged: Use client-side key rotation to thwart replay attacks.

Challenges persist, but data tempers hype. FHE’s noise accumulation caps circuit depth at 10-20 levels without bootstrapping, per TFHE specs – fix via Zama’s optimized refreshers, slashing costs 50x. Gas? Ethereum L2s hit 1M gas per eval; Fhenix offloads to CoFHE for sub-100k. Opinion: Institutions love this – confidential governance votes tally encrypted, dodging whale signaling. DERO’s homomorphic ledgers aggregate yields privately, testnet data shows 15% efficiency gains over plain Zcash.

Scaling Homomorphic Encryption Blockchain Protocols for Production

Production means composability. Zama fhEVM shines: Pipe encrypted outputs into Uniswap forks seamlessly. OpenZeppelin’s token standard enforces this – audited transfers hide amounts, expose allowances via homomorphic sums. Benchmarks from Bankless: 1k TPS on Polygon zkEVM hybrids. Pair with threshold FHE for DAOs; quorum computes on shares, no single-key risk.

Fhenix pushes boundaries with Ethereum-native private apps. Their CoFHE hooks precompiles for multiply-add, enabling encrypted perps: leverage ratios stay blind, liquidations trigger on aggregates. Dev feedback? “Minimal Solidity rewrites, ” per Fhenix world. DERO embeds deeper – VM-native FHE for anonymous DEXes, hitting 10k TPS without L2 crutches. Cross-chain? Bridge via encrypted commitments.

FHEVM allows transaction data and on-chain states to remain encrypted end-to-end. – Zama on fhEVM

Security first: Audit noise parameters religiously. ePrint’s smartFHE flags side-channels in bootstrapping; mitigate with constant-time Rust impls. My protocol stack? fhEVM base layer, OpenZeppelin guards, Fhenix copro for bursts. Result: DeFi yields private as vaults, composable as Aave.

2026 metrics scream adoption: Fhenix TVL tops $500M simulated, Zama partnerships span 10 chains. Ethereum’s confidentiality layer unlocks institutional flows – think BlackRock tokenized funds with blinded NAVs. DERO’s edge? Sovereign privacy, no off-chain trust.

Devs, prototype today: Fork Zama’s GitHub repo, spin fhEVM localnet. Metrics will guide – track eval depth, bootstrap freq. FHE isn’t plug-and-play yet, but neither was EVM in 2015. Deploy FHE smart contracts, watch DeFi evolve from transparent toy to fortified fortress. Your encrypted edge awaits.