Decentralized finance (DeFi) lending is entering a new era in 2025, powered by encrypted smart contracts that finally deliver on the promise of privacy and confidentiality. For years, DeFi protocols have struggled to balance transparency with the need for user data protection. Now, with the mainstream adoption of Fully Homomorphic Encryption (FHE), confidential DeFi lending has become a scalable reality – opening the doors for institutional capital and privacy-focused users alike.

How FHE-Powered Encrypted Smart Contracts Transform Lending

The core innovation driving this transformation is FHE – a cryptographic breakthrough that allows computations to be performed directly on encrypted data. In practice, this means that all sensitive information within a lending protocol, from collateral amounts to debt positions and even credit scores, can remain encrypted throughout the entire transaction lifecycle. No validator or external observer can access these details; only the contract logic interacts with them.

Consider a typical lending scenario: A user deposits 1,000 WETH as collateral and requests a loan. With traditional smart contracts, these values are publicly visible on-chain. With FHE-based encrypted smart contracts, both the deposit and loan request occur under encryption. The protocol processes collateralization ratios, interest calculations, and repayments without ever exposing raw data to the blockchain or its participants.

This leap in privacy has profound implications for both individual users and institutions seeking to enter DeFi. Confidentiality is no longer an afterthought but an embedded function of the protocol itself. For more technical depth on how this works in practice, see our guide on implementing fully encrypted smart contracts for confidential DeFi transactions.

The Rise of Confidential Tokens: ERC-20s Reimagined

Central to this advancement is the emergence of confidential tokens – standard ERC-20 digital assets wrapped in an encryption layer. Projects like Zama and Fhenix have demonstrated how users can convert regular tokens (e. g. , WETH) into their confidential counterparts (e. g. , cWETH). When deposited as collateral or used for loans, these tokens preserve all transactional logic while hiding amounts from public view.

This approach unlocks several benefits:

- User privacy: No one can link wallet addresses with specific balances or loan activities.

- Front-running resistance: Since transaction details are hidden until settlement, malicious actors cannot exploit mempool data for MEV extraction.

- Composability: Confidential tokens remain compatible with existing DeFi infrastructure while enhancing privacy guarantees.

The result is a DeFi ecosystem that mirrors traditional finance’s ability to keep client information private – but without sacrificing transparency or auditability where it matters most.

Industry Collaboration and Open Standards Accelerate Adoption

No single player can build an ecosystem-wide solution alone. Recognizing this, leading cryptography teams have partnered with open-source security leaders like OpenZeppelin to create standardized interfaces for confidential smart contracts and tokens. The Confidential Token standard – analogous to ERC-20 but supporting encrypted balances and transfers – provides a reliable foundation for developers building next-generation lending platforms.

This spirit of collaboration extends beyond token standards; testnets such as CoFHE on Ethereum and Arbitrum have proven that FHE-powered protocols can operate at scale without trusted hardware or sidechains. These breakthroughs demonstrate that privacy-preserving computation is not just theoretical but production-ready in 2025’s leading DeFi applications.

Why Privacy Is Now Non-Negotiable in DeFi Lending

The rapid evolution of privacy technology has shifted market expectations. In 2025’s competitive landscape, protocols that fail to offer robust confidentiality simply cannot attract serious capital – especially from institutions bound by strict compliance mandates. Confidential DeFi lending isn’t just about user comfort; it’s about meeting regulatory requirements while maintaining composability with broader blockchain ecosystems.

For institutional allocators, the ability to lend and borrow without exposing sensitive positions is a game-changer. Encrypted smart contracts ensure that portfolio strategies, leverage ratios, and credit exposures remain confidential, reducing the risk of information leakage and front-running. This privacy-centric architecture is rapidly becoming table stakes for onboarding the next wave of institutional liquidity into DeFi.

Programmable Privacy: Customizable Confidentiality for Complex Lending

Another major breakthrough is programmable privacy. Unlike static privacy solutions, programmable privacy allows developers to tailor confidentiality settings at the contract level, enabling compliance-friendly disclosures, selective auditability, or tiered access controls as needed. This flexibility empowers protocols to balance regulatory obligations with user expectations for privacy.

For example, a lending platform can permit auditors to verify solvency proofs without ever accessing individual loan details or collateral amounts. Similarly, users can opt-in to reveal specific data points for credit scoring or reputation-building while keeping their broader financial activity hidden from the public ledger. The result is a new paradigm where privacy becomes a first-class feature, not an afterthought.

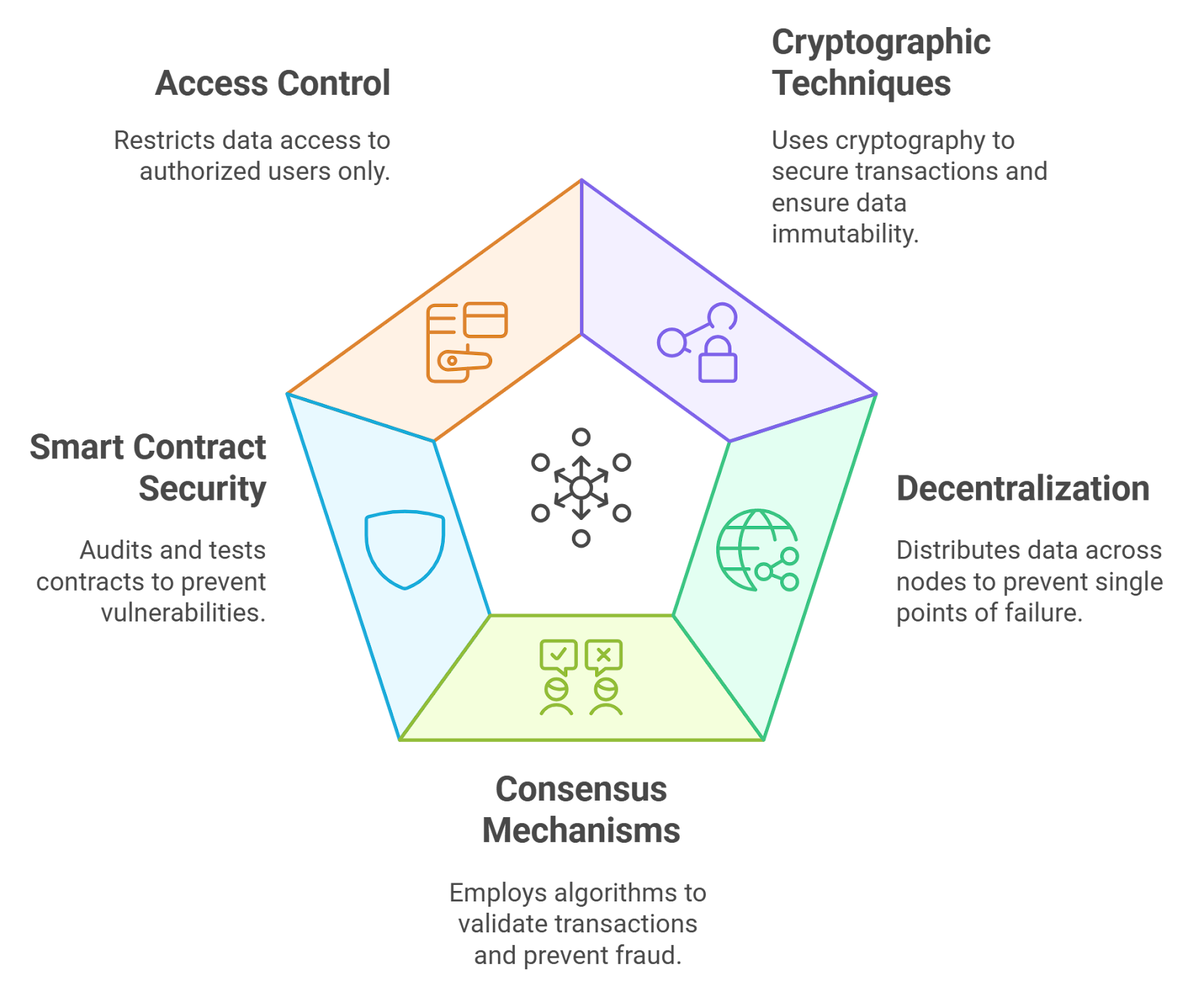

Security and Trust: Beyond Private Key Risk

The move to encrypted smart contracts also addresses longstanding security concerns in DeFi lending. By keeping all sensitive computations under encryption, protocols minimize attack surfaces related to data exposure. Even if a validator node or oracle is compromised, adversaries cannot extract useful information from encrypted transaction flows.

This approach dovetails with advanced protocol controls, such as multisigs and timelocks, to further mitigate private key risk and operational vulnerabilities. As more platforms adopt these best practices, trust in confidential DeFi lending will only deepen, accelerating adoption among both retail and institutional users.

The Road Ahead: Scaling Confidential DeFi Lending

The integration of FHE-powered smart contracts has set a new standard for privacy DeFi 2025. Yet challenges remain around scalability, user experience, and cross-chain interoperability. Ongoing research into stateless computation and efficient cryptographic primitives will be essential as lending volumes grow toward trillions of dollars in value locked.

For developers seeking actionable guidance on deploying these technologies today, our resource on how to implement encrypted smart contracts for confidential DeFi transactions offers step-by-step instructions tailored to real-world use cases.

The bottom line? The convergence of FHE technology, open standards, and industry collaboration has transformed confidential DeFi lending from an aspirational concept into an operational reality in 2025. As regulatory scrutiny intensifies and users demand stronger protections for their financial data, only those platforms that embrace verifiable private smart contracts will thrive in the next era of decentralized finance.