In 2025, the world of decentralized finance (DeFi) is undergoing a profound transformation, thanks to the rapid adoption of encrypted smart contracts. These technological advancements are not just incremental upgrades; they are fundamentally redefining how privacy and confidentiality operate in open financial systems. For years, the public nature of blockchains left sensitive user data and trading strategies exposed. Now, with the integration of cutting-edge cryptographic techniques like Fully Homomorphic Encryption (FHE), confidential DeFi transactions are finally a reality.

The Shift from Public to Confidential DeFi

Traditionally, every operation on a public blockchain is visible to anyone with an internet connection. This transparency ensures trustlessness but comes at the cost of privacy. In DeFi, this exposure can be particularly problematic: trade sizes, liquidation thresholds, and even governance votes become public knowledge, opening the door to front-running and other exploitative behaviors.

Enter confidential DeFi. By leveraging encrypted smart contracts powered by FHE and related cryptographic primitives, platforms now allow users to interact with protocols without revealing their transaction details or strategies. Sensitive information such as bid amounts in auctions or personal asset balances remains encrypted throughout computation and storage. The result? A paradigm shift where privacy is not an afterthought but a foundational feature.

Key Innovations Powering Private DeFi Transactions

The pace of innovation in 2025 has been nothing short of remarkable. Several key players have emerged as pioneers in bringing privacy-preserving smart contracts to market:

- Zama’s Confidential Blockchain Protocol: This protocol delivers end-to-end encryption for transaction inputs and states across both Layer 1 and Layer 2 chains. Developers can now build dApps that are both confidential and composable, meaning private contracts can interact seamlessly with traditional ones.

- Fhenix’s CoFHE Testnet: Fhenix has introduced an encrypted coprocessor compatible with Ethereum and Arbitrum testnets. It enables real FHE-powered computations within Solidity-based smart contracts, allowing for stateless off-chain operations that maximize both scalability and privacy.

- Zama and OpenZeppelin Partnership: This collaboration produced a Confidential Token standard, imagine ERC-20 but with balances and transactions fully encrypted, and a suite of contract templates for building everything from sealed-bid auctions to private governance modules.

- Chainlink Confidential Compute: By integrating confidential computing into its oracle services, Chainlink now enables secure data feeds for smart contracts without exposing sensitive off-chain information on-chain.

Together, these breakthroughs are addressing long-standing challenges in blockchain privacy by making it possible to perform complex computations directly on encrypted data, without ever decrypting it on-chain.

The Impact: Privacy Without Compromise

The implications for users and institutions alike are significant. Enhanced privacy fosters greater trust among individuals who may have previously hesitated to participate in DeFi due to concerns about surveillance or competitive disadvantage. For institutional players bound by strict compliance requirements, confidential smart contracts offer a path forward, enabling them to engage in decentralized markets while safeguarding client data.

This new wave of innovation is also unlocking entirely new classes of financial products: think private lending pools where borrower details remain hidden or compliant privacy tokens that satisfy both regulatory scrutiny and user confidentiality needs. As more developers adopt these tools, expect an explosion of creative use cases that were previously considered impossible on public blockchains.

How Encrypted Smart Contracts Actually Work

The magic behind these advances lies in sophisticated cryptographic techniques like FHE, which allows computation over encrypted data, and secure multi-party computation (MPC). With FHE-based solutions such as those pioneered by Zama and Fhenix, contract logic executes as normal but all sensitive variables remain encrypted throughout their lifecycle. Only authorized parties can decrypt results if necessary, ensuring that even node operators cannot access private user data.

If you’re interested in exploring practical steps for building your own confidential dApps using these emerging standards, see our guide on how to implement encrypted smart contracts for confidential DeFi transactions.

What sets the current generation of privacy-preserving smart contracts apart is their ability to balance confidentiality with composability and compliance. Developers are no longer forced to choose between privacy and interoperability; confidential contracts can now interact with public ones through carefully designed permissioning frameworks. This opens up a spectrum of hybrid applications, where only the most sensitive elements are kept private, while other logic remains transparent for auditability and trust.

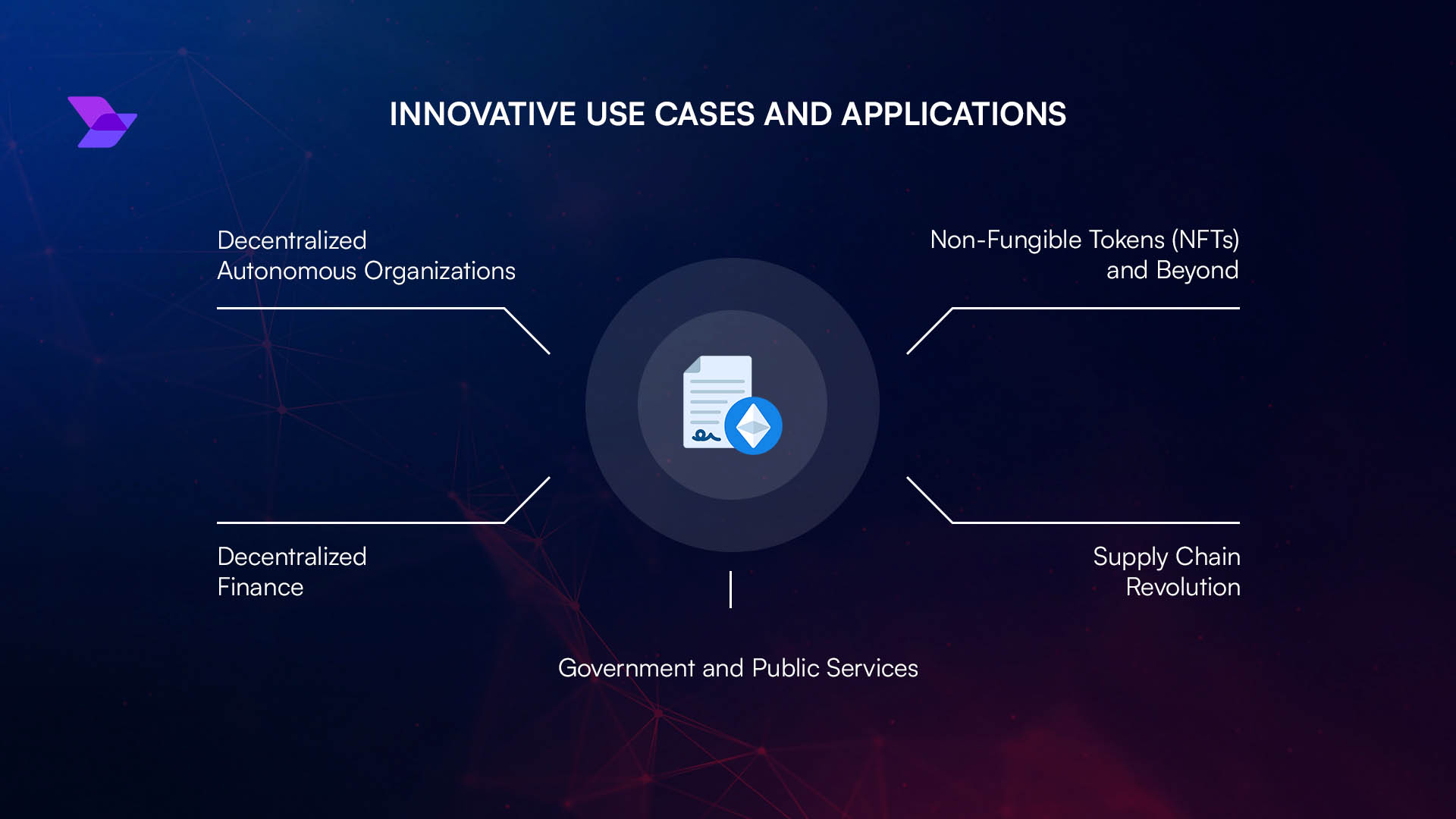

Real-World Confidential DeFi Use Cases in 2025

-

Private Lending Pools with Zama’s Confidential Blockchain Protocol: Platforms leveraging Zama’s protocol now offer lending pools where both loan amounts and borrower identities remain encrypted throughout the process, protecting sensitive financial data while enabling composable DeFi strategies.

-

Sealed-Bid Auctions via Fhenix CoFHE on Ethereum: Fhenix’s CoFHE testnet empowers decentralized applications to run sealed-bid auctions, ensuring that all bids remain encrypted until the auction ends, preventing front-running and guaranteeing fair outcomes.

-

Privacy-Compliant Stablecoins with Zama & OpenZeppelin Confidential Tokens: The Confidential Token standard, developed by Zama and OpenZeppelin, enables stablecoins with encrypted balances and transaction histories, supporting regulatory compliance while preserving user privacy.

-

Confidential Real-World Asset Tokenization with Chainlink Confidential Compute: Chainlink’s Confidential Compute facilitates the private tokenization and transfer of real-world assets—like real estate or commodities—on public blockchains, ensuring transaction details and ownership remain confidential.

-

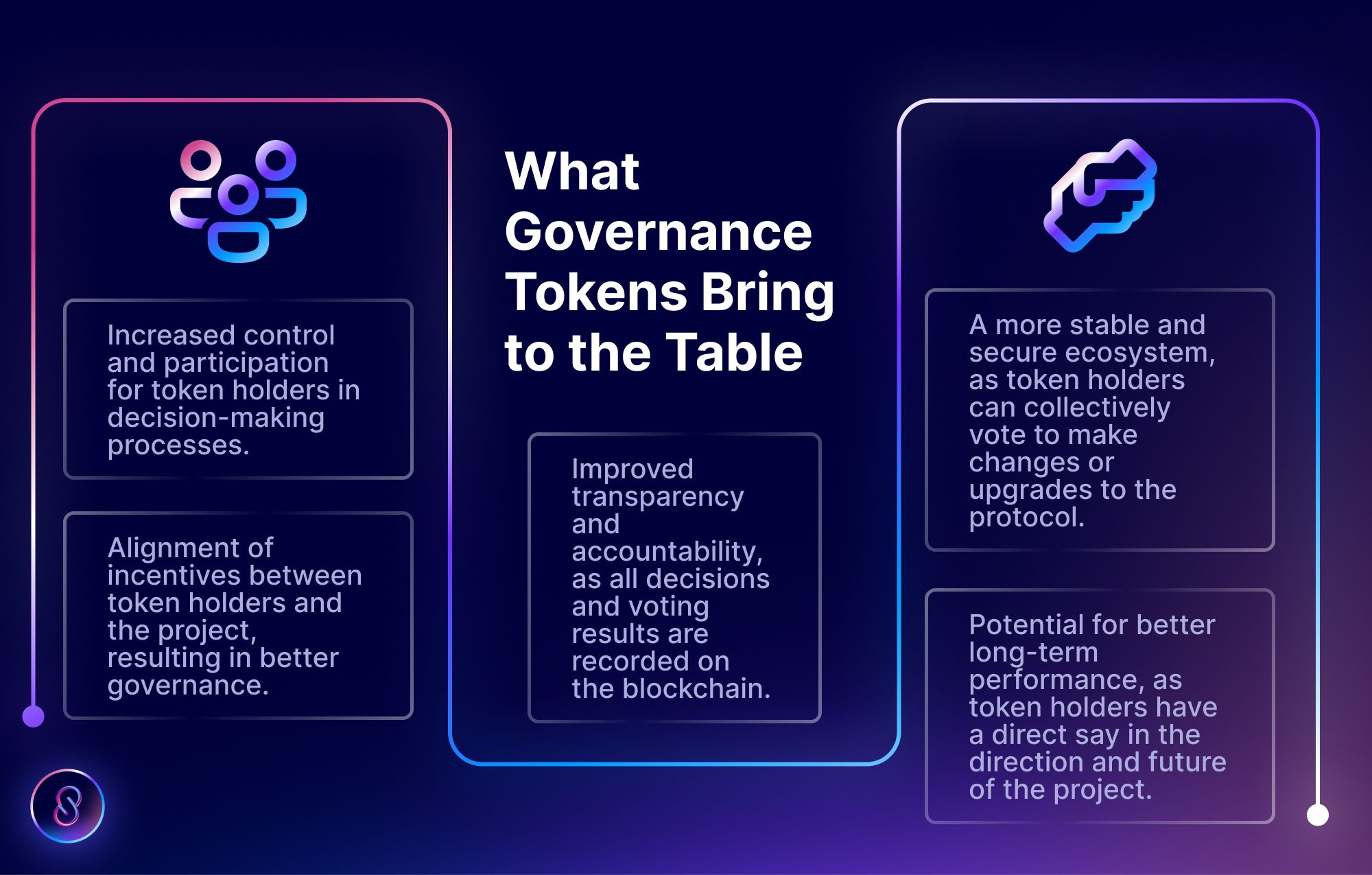

Private DeFi Governance and Voting: Protocols using FHE-based smart contracts (such as those built on Fhenix or Zama) now offer confidential on-chain governance, where votes are encrypted, ensuring privacy and mitigating vote manipulation risks.

For end-users, the experience of interacting with DeFi is becoming more intuitive and secure. Wallets and dApps are integrating privacy toggles, allowing users to select when and how their data is encrypted. Institutional funds can participate in on-chain lending or trading without disclosing proprietary strategies or client identities, a breakthrough for mainstream adoption.

Addressing Skepticism: Transparency vs. Privacy

Despite these advances, some critics worry that confidential DeFi may erode the transparency that made blockchains trustworthy in the first place. However, modern solutions often employ zero-knowledge proofs (ZKPs), enabling validators to confirm correct execution of contract logic without revealing underlying data. This ensures that private DeFi doesn’t become a black box, regulators and auditors can still verify compliance without blanket access to all user information.

For a deeper dive into how this balance is achieved, and why it matters for both security and regulatory acceptance, see our resource on how confidential smart contracts enable private verifiable DeFi transactions.

Developer Enablement: Tooling and Templates

The maturation of developer tooling has been pivotal in accelerating adoption. OpenZeppelin’s partnership with Zama brought forth a library of audited templates tailored for encrypted smart contracts, lowering the barrier for teams wanting to build compliant privacy dApps. Fhenix’s Solidity compatibility means existing Ethereum developers don’t need to learn an entirely new stack to start building confidential applications.

This democratization of privacy tech is already bearing fruit: we’re seeing open-source modules for private voting, sealed-bid auctions, and even tokenized real-world assets with selective disclosure controls emerge across multiple ecosystems.

Challenges Ahead and What’s Next

No technology is without trade-offs. Performance overheads from FHE computations remain a challenge but ongoing research, especially around stateless off-chain computation, is rapidly closing the gap. User education will be critical as well; understanding permission controls and encryption boundaries will empower users to make informed decisions about their data.

The next wave will likely focus on cross-chain confidentiality, allowing assets and data to move privately between blockchains, and even more seamless integration with regulatory frameworks worldwide.

The landscape has shifted decisively toward user-centric privacy without sacrificing composable innovation or regulatory alignment. As these technologies mature further into 2026 and beyond, expect confidential DeFi transactions powered by encrypted smart contracts to become not just a feature, but an industry standard for secure blockchain finance.