Prediction markets have long been touted as one of blockchain’s most promising use cases, but public ledgers like Ethereum have always struggled with a fundamental challenge: privacy. When every bet, wallet address, and outcome is visible to the world, user anonymity and strategic confidentiality are impossible. Enter confidential smart contracts, a breakthrough that’s rapidly transforming how private prediction markets operate on Ethereum, without sacrificing security or decentralization.

Why Privacy Matters in Prediction Markets

Traditional blockchain prediction markets are transparent by design. While this transparency builds trust in outcomes, it also exposes sensitive user data, bet sizes, strategies, and wallet identities, to anyone watching the chain. This exposure creates risks for traders who want to protect their edge or simply value their privacy.

Confidential smart contracts solve this by using advanced cryptography to keep transaction details hidden from the public ledger. The result? Users can participate in markets without revealing their positions or identities, a critical step for both competitive traders and those seeking personal privacy.

The Tech Behind Encrypted Prediction Markets

The rise of private prediction markets on Ethereum is powered by several cutting-edge technologies:

Key Cryptographic Solutions Powering Confidential Smart Contracts

-

Trusted Execution Environments (TEEs): Hardware-based enclaves like Intel SGX enable confidential smart contract execution by isolating code and data from the rest of the system. TEEs are used by platforms such as Secret Network and Oasis Sapphire to keep prediction market data private.

-

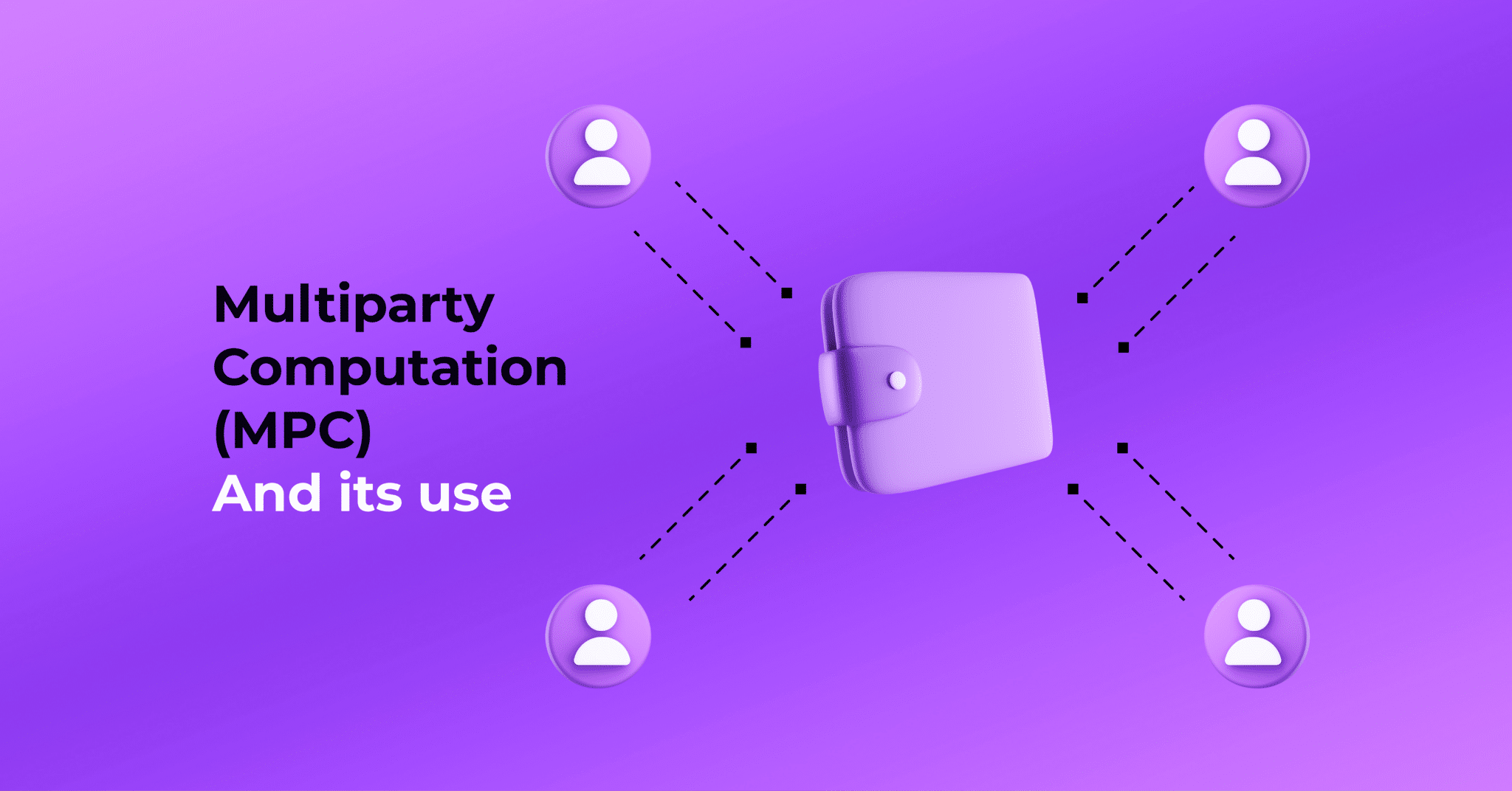

Multi-Party Computation (MPC): This cryptographic method allows multiple parties to jointly compute a function over their inputs while keeping those inputs private. Projects like Partisia Blockchain and Oasis Network leverage MPC to enable private, decentralized prediction markets on Ethereum-compatible chains.

-

Fully Homomorphic Encryption (FHE): FHE lets smart contracts process encrypted data without decrypting it, ensuring that sensitive information stays private throughout computation. FHE-Rollups by Fhenix are pioneering this approach on Ethereum.

-

Ring Signatures: Used to anonymize user transactions by making it computationally infeasible to determine which group member signed a transaction. The AnonMarket prediction market utilizes ring signatures to preserve participant anonymity.

-

CLOAK Framework: This framework enables confidential smart contracts with multi-party transactions and declarative privacy invariants, ensuring sensitive data remains hidden during contract execution on Ethereum.

Ring Signatures: Platforms like AnonMarket use ring signatures to anonymize transactions. Here, each bet is signed within a group, making it impossible to trace the origin back to an individual user. This technique ensures that even if someone inspects the blockchain, they can’t tell who placed which bet.

Multi-Party Transactions (MPT): Frameworks such as CLOAK enable developers to create smart contracts that keep sensitive data hidden, even during multi-party interactions. By specifying privacy rules directly in contract code, MPT frameworks guarantee that only authorized parties can access confidential information.

Fully Homomorphic Encryption (FHE): Perhaps the most futuristic approach comes from projects like FHE-Rollups. FHE allows computations on encrypted data without ever decrypting it, meaning bets and outcomes remain private even while being processed by the contract itself.

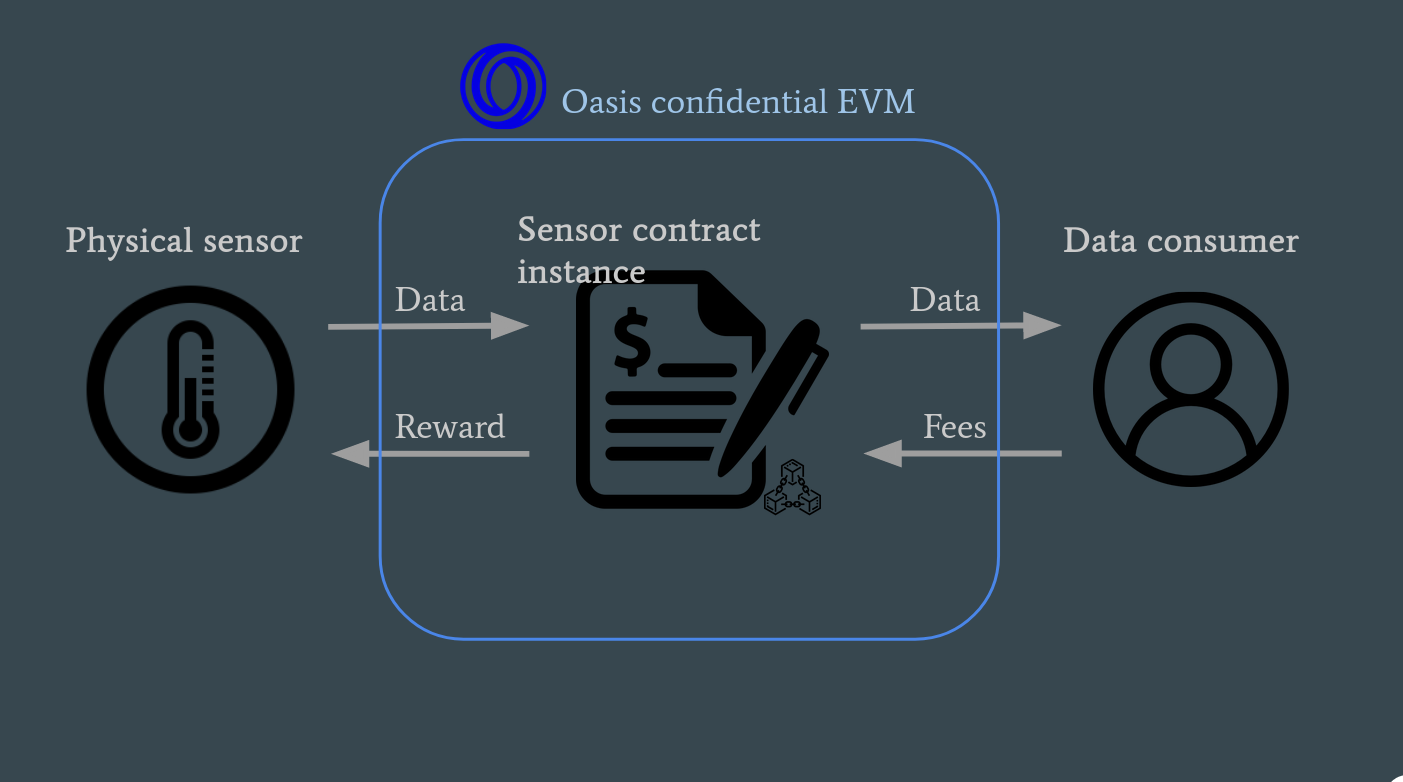

The Real-World Impact: PolyBet and Oasis Sapphire

A standout example of these innovations in action is PolyBet, built on Oasis Sapphire, a privacy-enabled EVM chain compatible with Ethereum. PolyBet encrypts everything from wallet addresses to bet sizes and market positions. This shields user activity from prying eyes and sets a new standard for what’s possible in decentralized betting platforms (source).

This approach isn’t just about hiding numbers; it’s about enabling entirely new market dynamics where whales can place large bets without moving odds unfairly or exposing themselves to copycats and front-runners.

The Confidential Smart Contract Landscape in 2025

The latest market context shows Ethereum trading at $3,996.57, reflecting both its continued dominance and the growing demand for privacy solutions as DeFi matures. As more users seek confidential ways to participate in prediction markets, and as regulatory scrutiny increases, the technologies behind encrypted smart contracts will only gain relevance.

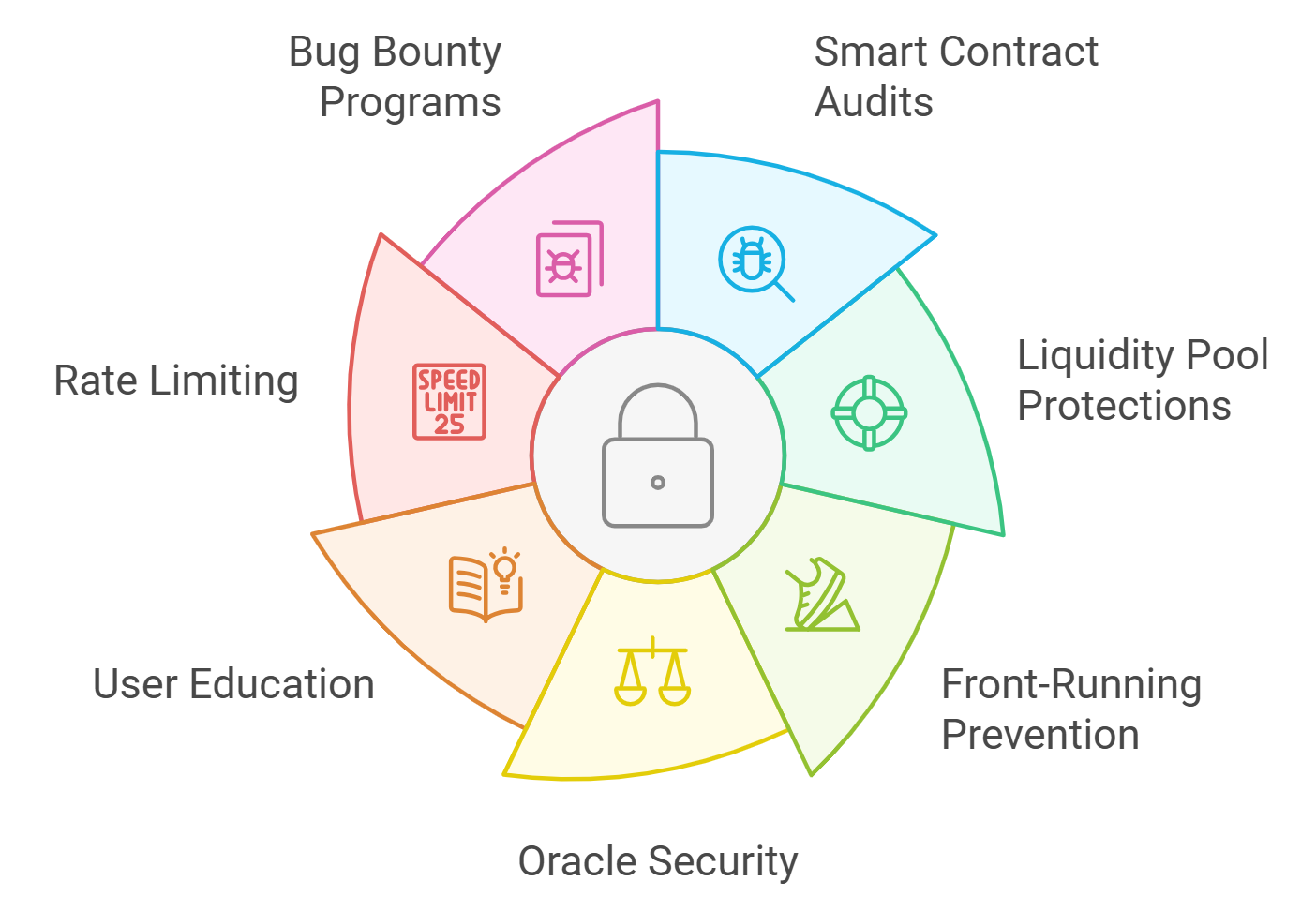

Yet, as promising as these privacy advances are, there are still hurdles to overcome. Scalability remains a top concern. Cryptographic techniques like FHE and secure multi-party computation (MPC) can be computationally intensive, sometimes leading to higher fees and slower transaction times. Developers are actively working on optimizing these protocols to minimize overhead while preserving robust privacy guarantees.

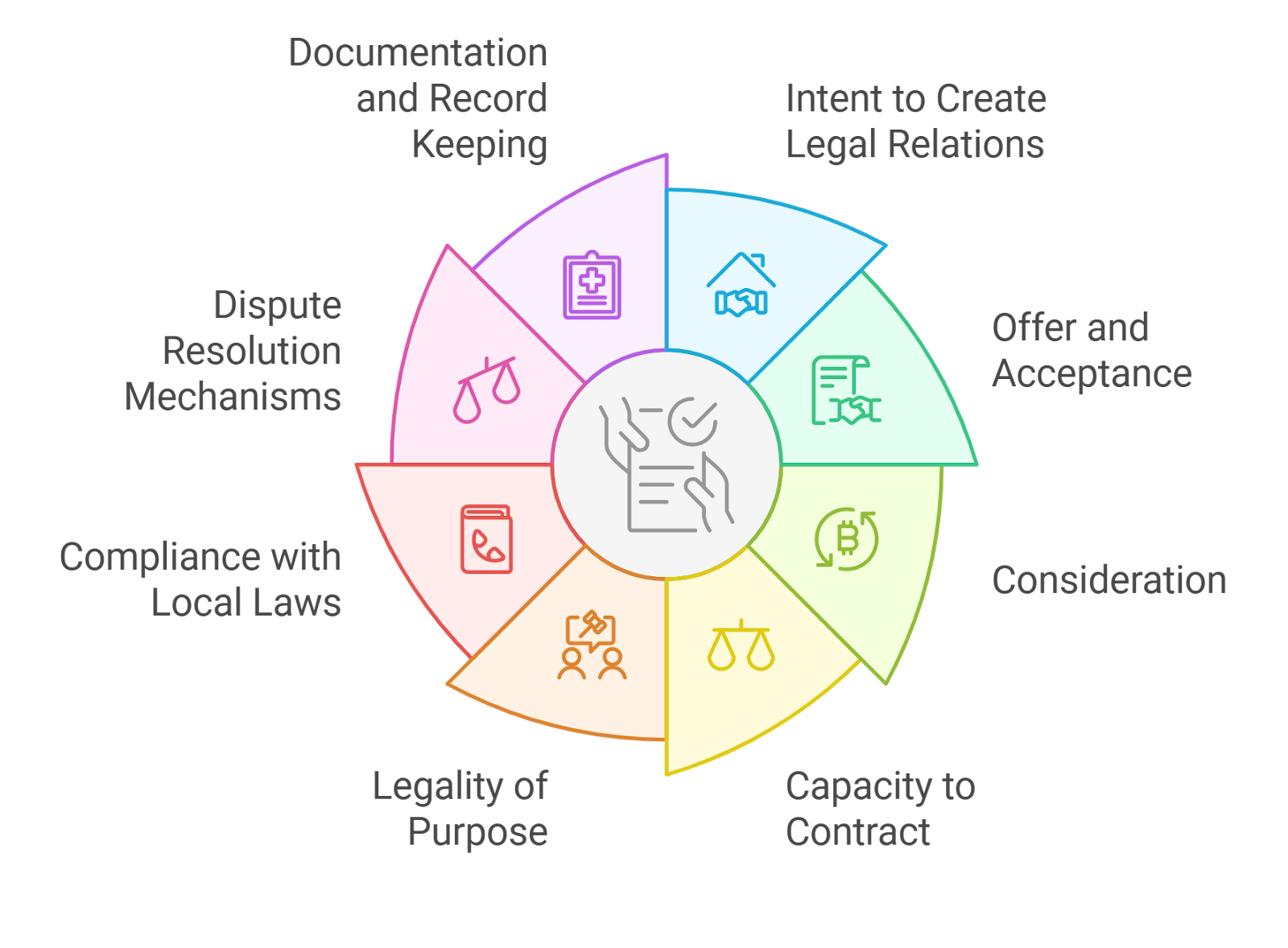

Regulatory compliance is another pressing issue. Prediction markets often operate in a gray area, and the addition of confidentiality features can make it harder for regulators to audit activity or ensure fair play. Projects must strike a balance between user privacy and compliance with evolving legal frameworks across jurisdictions. The debate over how much transparency is necessary versus how much privacy is possible will shape the next wave of DeFi innovation.

Oracles and Trust in Private Markets

No matter how private the contract logic is, prediction markets still need reliable data feeds, known as oracles, to resolve outcomes. The risk: if an oracle can be corrupted or manipulated, even the most private market loses its integrity. As such, confidential smart contracts often pair cryptographic privacy with decentralized oracle networks that use consensus mechanisms or trusted execution environments (TEEs) to securely deliver real-world data (source).

The use of TEEs smart contracts has gained traction here. TEEs provide a hardware-based way to execute code privately, shielding sensitive computations from both the blockchain validators and external attackers (source). However, recent research highlights that TEEs aren’t immune to vulnerabilities, ongoing audits and improvements are essential for maintaining trust (source).

What’s Next for Encrypted Smart Contracts?

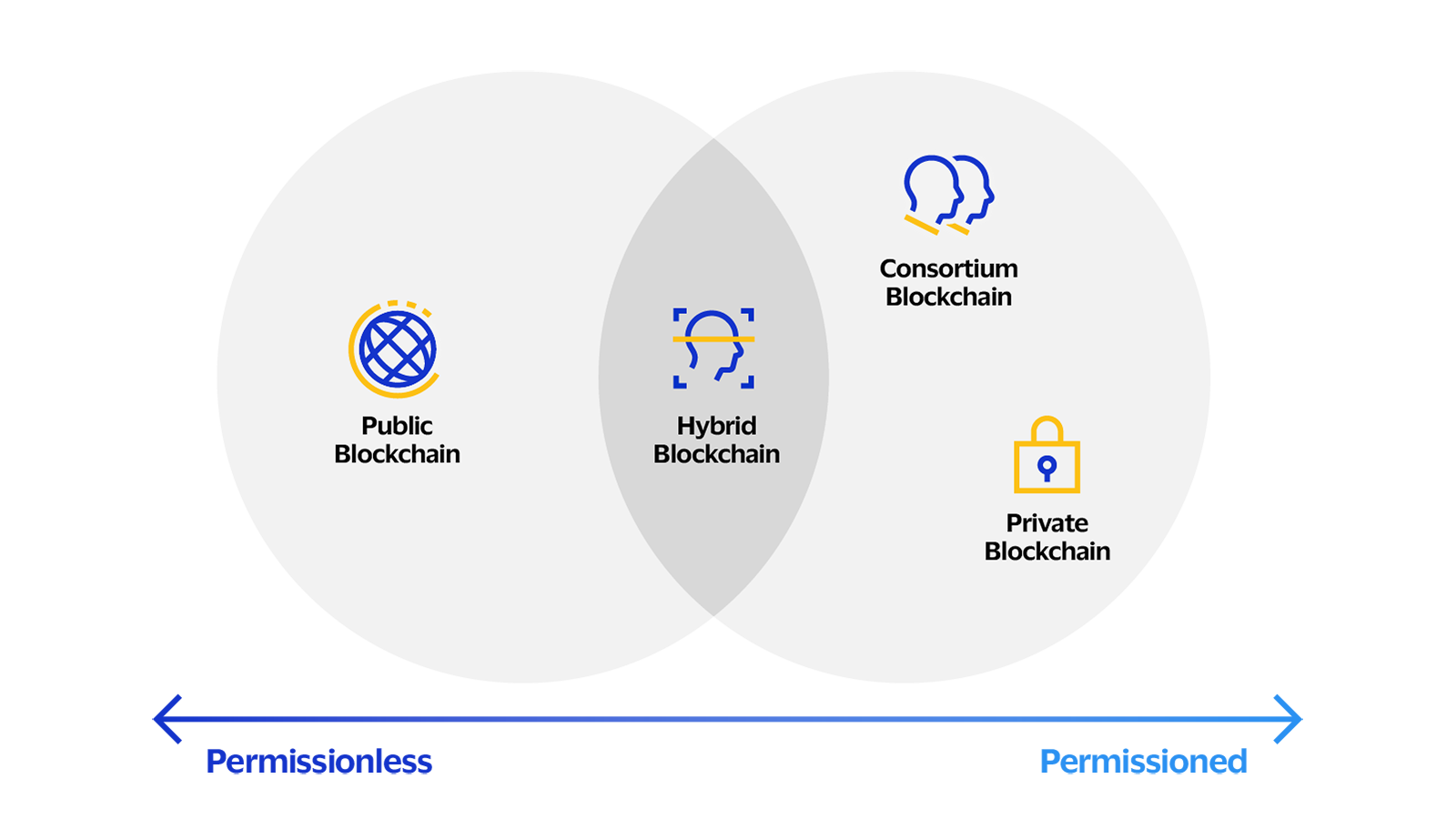

The landscape for private prediction markets is evolving rapidly. As Ethereum holds strong at $3,996.57, we’re likely to see more projects adopt FHE Ethereum solutions, advanced MPC protocols, and hybrid models combining both software- and hardware-based privacy layers.

Top Benefits of Confidential Smart Contracts in DeFi Prediction Markets

-

Enhanced User Privacy: Confidential smart contracts, like those used by AnonMarket, leverage ring signatures to anonymize user identities and transactions, ensuring that participants can place bets without revealing personal information on the public Ethereum ledger.

-

Protection of Sensitive Data: Platforms such as PolyBet (built on Oasis Sapphire) encrypt wallet addresses, bet sizes, and positions, safeguarding all user activities and financial details from public exposure.

-

Private Computation with FHE: FHE-Rollups enable smart contracts to process encrypted data directly, ensuring that sensitive prediction market logic and outcomes remain confidential throughout computation.

-

Customizable Privacy Controls: The CLOAK Framework allows developers to specify privacy requirements for multi-party transactions, giving users and market creators fine-grained control over what data stays private.

-

Reduced Risk of Front-Running and Collusion: By keeping bet amounts and positions hidden, confidential smart contracts minimize the risk of front-running and collusion, helping ensure fairer prediction market outcomes for all participants.

User experience is also improving fast. Early platforms required technical know-how just to participate; now, mobile-first apps like AnonMarket are making private betting accessible to anyone with a smartphone (source). We’re witnessing the start of a new era where blockchain privacy isn’t just an option, it’s becoming table stakes for competitive DeFi products.

The bottom line: Confidential smart contracts are paving the way for truly decentralized, censorship-resistant betting ecosystems where users control their own data, and their destinies.