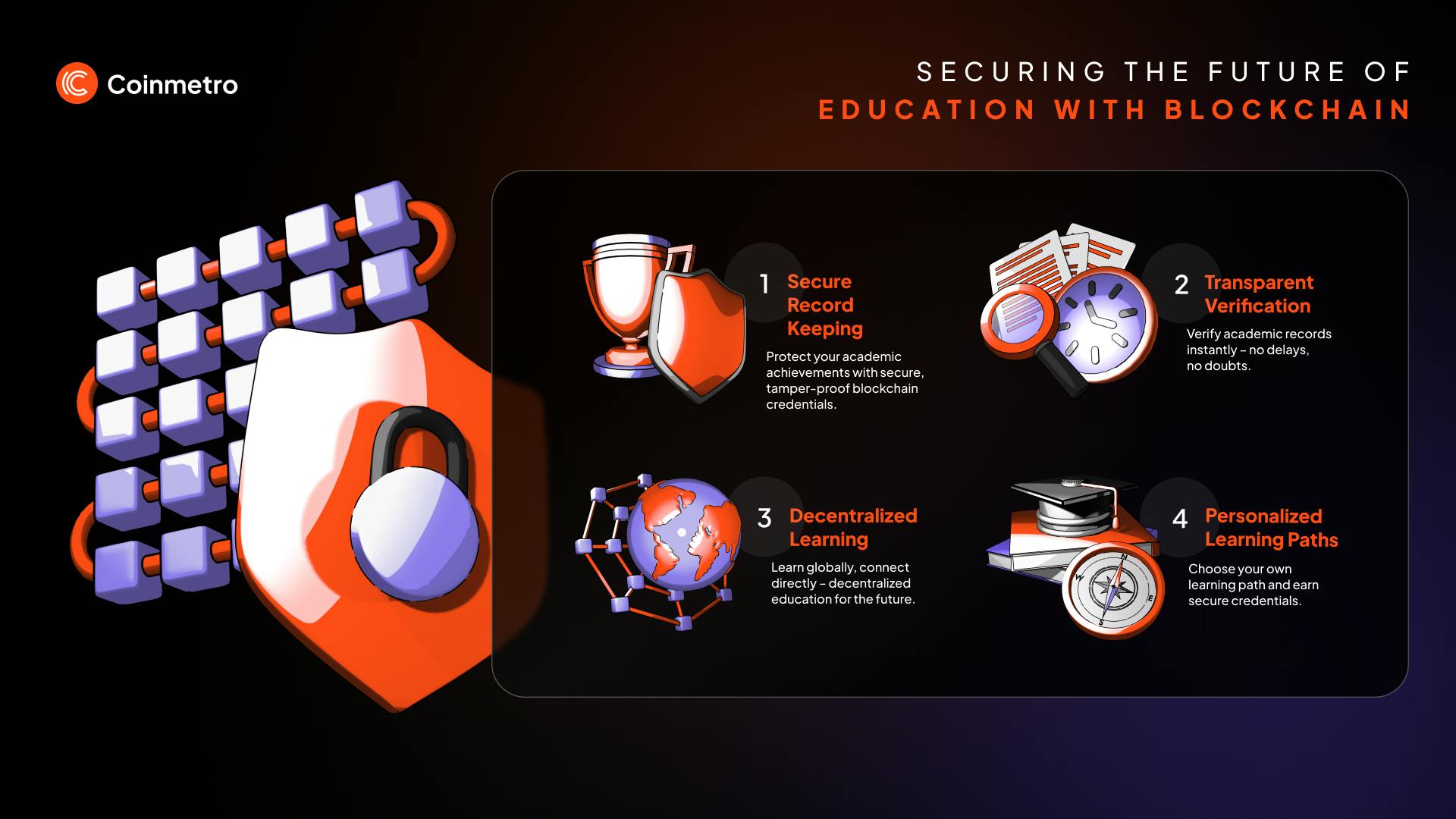

Decentralized finance (DeFi) thrives on transparency, but what if privacy could be engineered into the core of every trade, without pushing compliance out of reach? Enter confidential smart contracts, a new breed of blockchain protocols that blend cryptographic secrecy with regulatory rigor. As regulators like the CFTC intensify scrutiny and institutions demand privacy for sensitive trades, the next wave of DeFi innovation is here: private trading that remains verifiable, auditable, and compliant.

Why Privacy Matters in DeFi Trading

On public blockchains, every transaction is visible, asset swaps, portfolio rebalancing, even arbitrage strategies. For sophisticated traders and enterprises, this transparency is a double-edged sword. Competitors can front-run large orders or reverse-engineer proprietary strategies. More critically, sensitive financial data risks exposure to hackers and surveillance. Confidential smart contracts address these pain points by encrypting transaction logic and data while still allowing for on-chain verification.

“Confidentiality isn’t about hiding from the law, it’s about protecting strategic advantage while staying within it. “

The Cryptographic Toolkit: How Confidential Smart Contracts Work

The secret sauce behind private DeFi trading lies in advanced cryptography:

Key Technologies Powering Confidential Smart Contracts

-

Zero-Knowledge Proofs (ZKPs): Enable transaction validation without revealing underlying data, preserving privacy while ensuring correctness. Widely used in privacy-focused DeFi protocols.

-

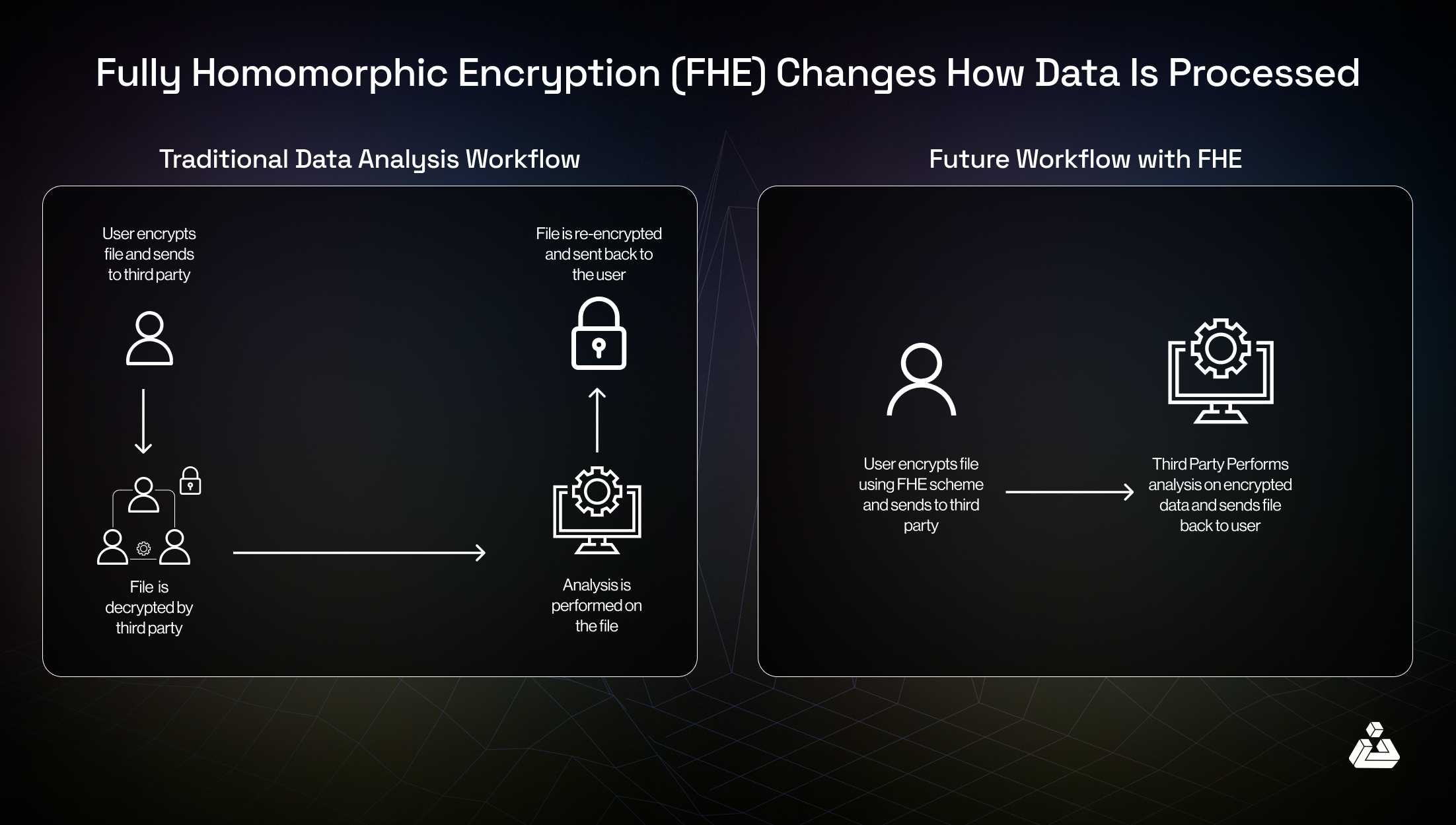

Fully Homomorphic Encryption (FHE): Allows smart contracts to compute directly on encrypted data, keeping sensitive information confidential throughout the process. Pioneered in DeFi by platforms like Zama.

-

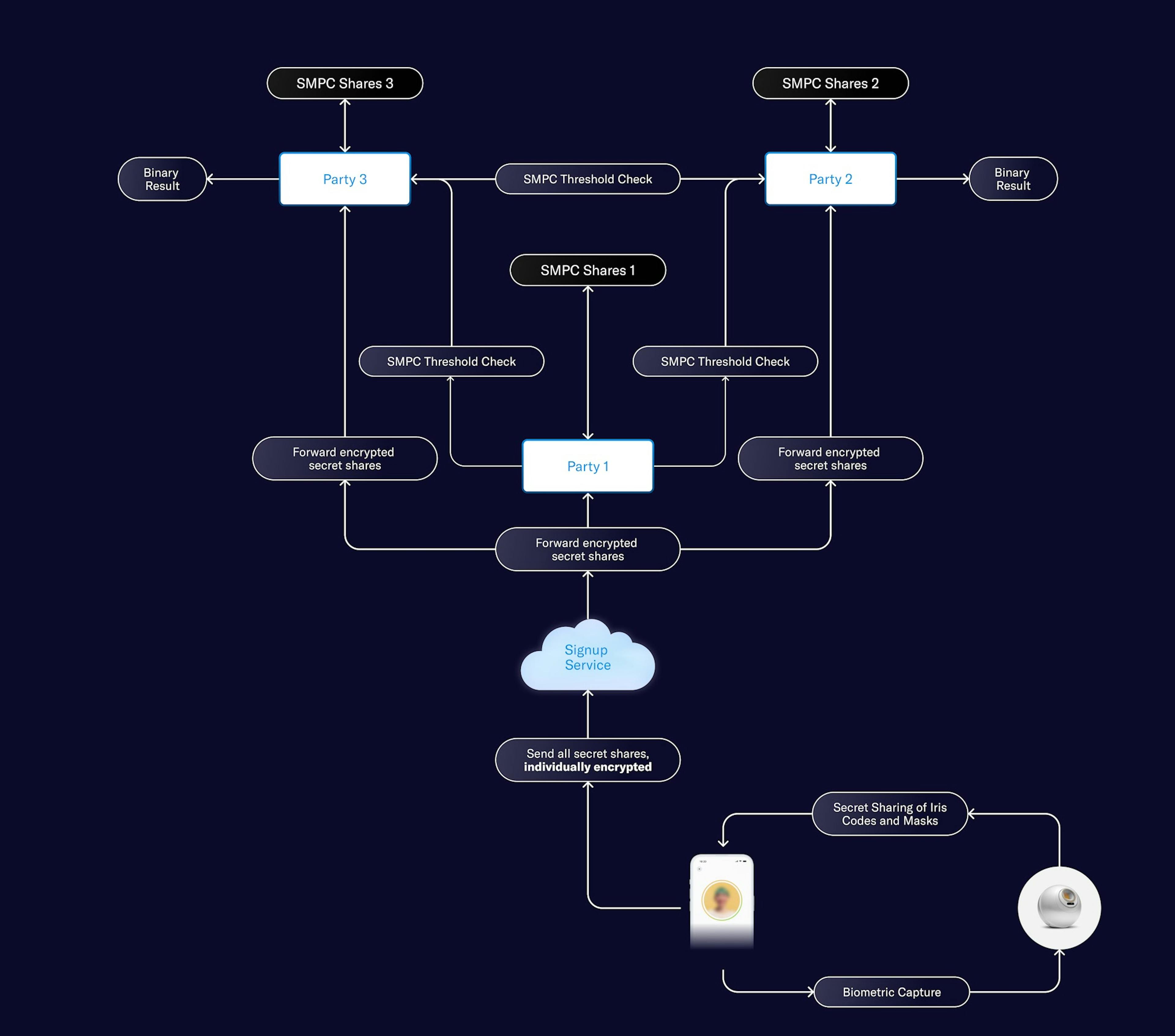

Secure Multi-Party Computation (MPC): Facilitates collaborative computations among multiple parties without exposing individual inputs, essential for private auctions and compliance in DeFi.

Zero-Knowledge Proofs (ZKPs): ZKPs let users prove that a transaction meets certain rules without revealing amounts or participants. In practice, this means you can validate a swap or loan without exposing your wallet balance to the world. Read more about ZKPs in DeFi.

Fully Homomorphic Encryption (FHE): With FHE, computations happen directly on encrypted data, imagine running an options contract or perpetual DEX trade without decrypting your position size or collateral until settlement. This keeps sensitive numbers shielded from both competitors and external observers. Explore FHE-powered smart contracts here.

Secure Multi-Party Computation (MPC): When multiple parties need to collaborate, think joint liquidity pools or private auctions, MPC lets them compute outcomes together without sharing their individual bids or positions.

Compliance Without Compromise: Privacy Meets Regulation

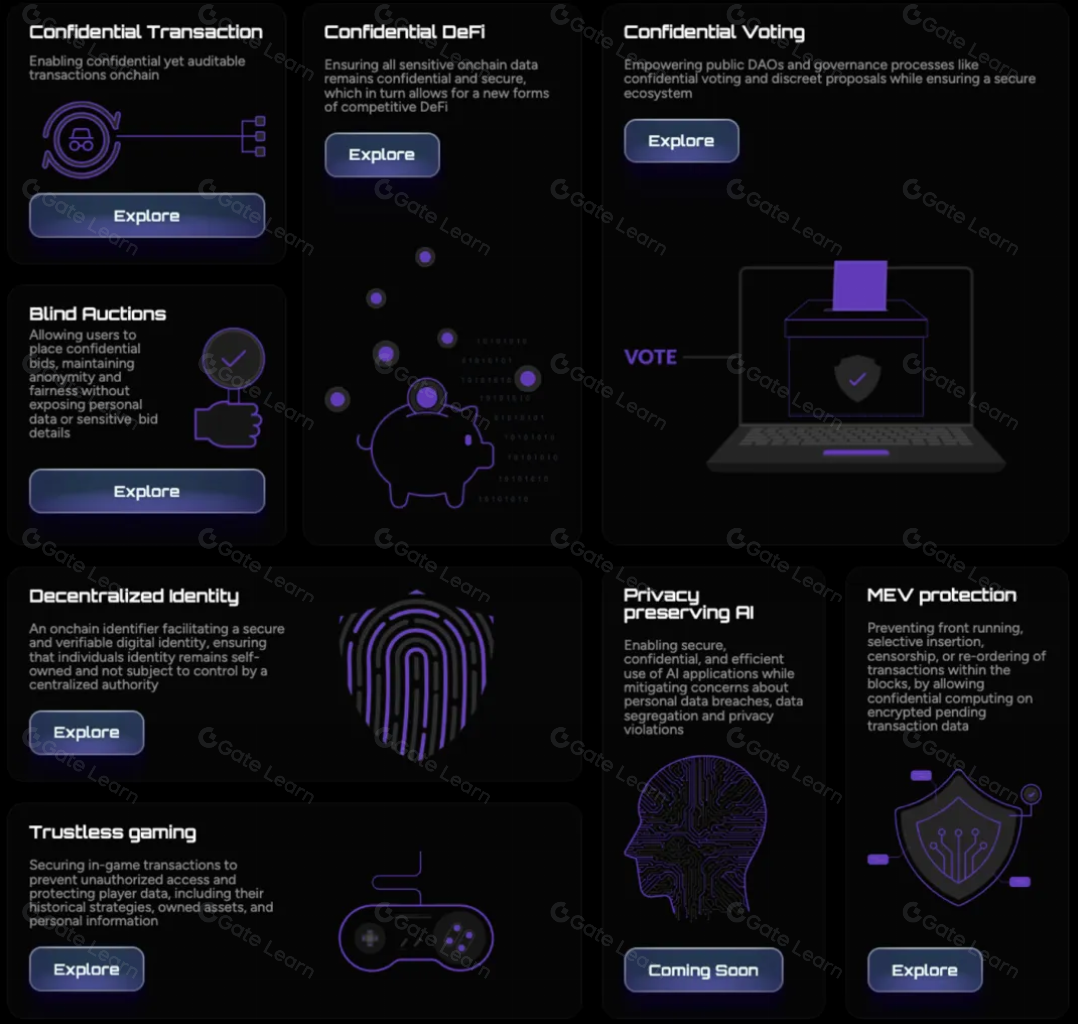

The real breakthrough of confidential smart contracts is their ability to automate compliance while keeping user data private. Modern protocols can embed AML/KYC checks directly into contract code using privacy-preserving analytics tools. For example:

- Anonymity sets: Transactions are grouped so individual trades can’t be traced back to specific users unless thresholds are triggered.

- On-chain monitoring: Smart contracts automatically flag suspicious activity (like rapid high-value transfers) for further review.

- Selectively auditable transactions: Trusted committees can decrypt specific trades if required by regulators, without exposing all network activity.

This approach is already live in solutions like Silent Protocol (see technical deep dive here) and Secret Network’s privacy-preserving dApps (learn more about Secret Finance). The result: institutional-grade confidentiality layered with programmable compliance triggers.

Pioneers in Private DeFi: Real-World Implementations

The race for encrypted perpetual DEXs and privacy-compliant protocols is heating up:

Top Confidential Smart Contract Projects in DeFi

-

Silent Protocol brings privacy to Ethereum dApps using zk-SNARKs, stealth addresses, and an anonymity set. It enables private asset transfers while allowing a compliance committee to decrypt transaction details if needed, balancing privacy with regulatory requirements.

-

Zama & OpenZeppelin Partnership leverages Fully Homomorphic Encryption (FHE) to create a confidentiality layer for blockchain smart contracts. This collaboration enables secure, private DeFi applications that meet institutional compliance standards.

-

Secret Network offers privacy-preserving smart contracts called Secret Contracts, which keep user data private by default. This enables secure DeFi interactions without exposing identities or sensitive transaction details.

Zama’s partnership with OpenZeppelin brings FHE-powered confidentiality to Ethereum-compatible chains, a game-changer for institutional adoption (details here). Meanwhile, projects like Silent Protocol use zk-SNARKs and stealth addresses to enable anonymous yet auditable trades on Ethereum’s mainnet.

Secret Network pushes the envelope by making privacy the default for all DeFi transactions. Their architecture ensures that even smart contract logic and state changes remain shielded from public view, while select compliance triggers can be activated if regulatory intervention is required. This dual-layer approach is crucial as DeFi platforms mature and face increasing scrutiny from bodies like the CFTC, which recently issued enforcement actions against non-compliant protocols. Explore Secret Finance’s privacy model.

For traders and institutions, this means participating in private DeFi trading without sacrificing access to liquidity or composability. Encrypted perpetual DEXs, powered by FHE and ZKPs, allow for complex derivatives trading with position sizes, leverage ratios, and liquidation thresholds all encrypted on-chain. Only authorized parties can decrypt sensitive data when legally necessary, everyone else sees a privacy-preserving ledger.

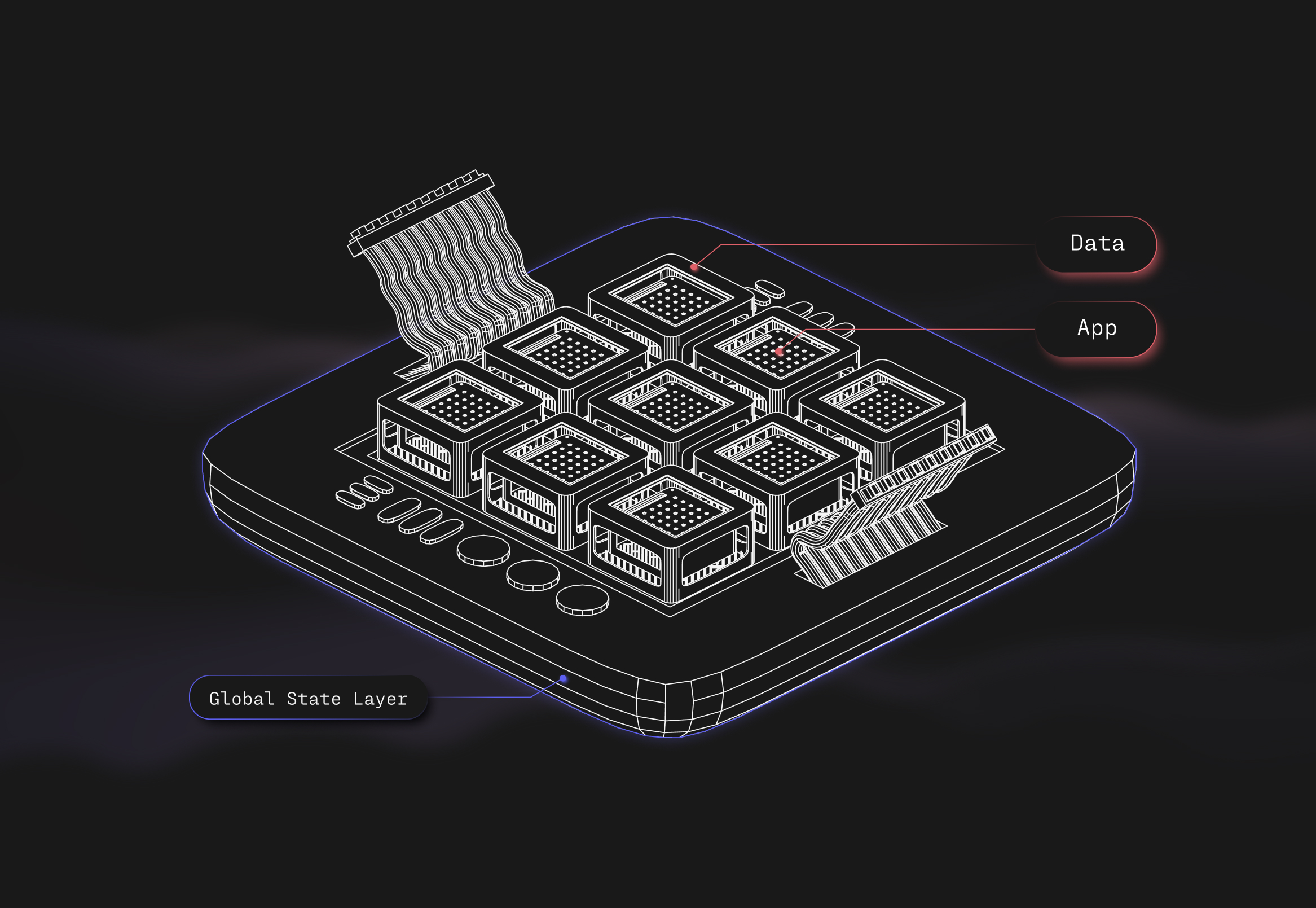

Visualizing the Future: Privacy Compliance Blockchain in Action

The next evolution of privacy preserving smart contracts will be highly visual, interactive, and user-friendly. Imagine dashboards where users see their portfolio analytics without revealing any underlying trade data to third parties. Compliance officers get just-in-time access to flagged transactions via selective disclosure mechanisms, no more blanket surveillance or trust-minimized guesswork.

Key Features of Compliant & User-Friendly Privacy Protocols

-

Zero-Knowledge Proofs (ZKPs): Enable users to prove transaction validity or identity compliance without exposing sensitive data, balancing privacy with regulatory needs.

-

On-Chain Compliance Automation: Integrate mechanisms for AML and KYC checks directly into smart contracts, ensuring regulatory adherence without manual intervention.

-

Fully Homomorphic Encryption (FHE): Allow computations on encrypted data so that sensitive information remains confidential throughout all contract operations.

-

Secure Multi-Party Computation (MPC): Facilitate collaborative transactions and analytics without exposing individual user data, essential for privacy-preserving DeFi functions.

-

Granular Permission Controls: Provide users and institutions with customizable privacy settings and access controls, enabling selective data sharing for audits or compliance.

-

Auditable Privacy Layers: Offer privacy by default but allow authorized parties (such as compliance officers) to decrypt transaction details when legally required, as seen in Silent Protocol.

-

User-Centric Experience: Ensure privacy features are intuitive and do not complicate onboarding, as exemplified by Secret Network and Silent Protocol.

Key benefits of this approach include:

- Confidentiality by default: All trades are shielded unless a compliance event is triggered.

- Automated compliance workflows: Regulatory checks run natively within contract code, not via external intermediaries.

- No compromise on composability: Private contracts interact seamlessly with public DeFi protocols using encrypted bridges and proof systems.

- User-centric design: Traders control what data is shared, when, and with whom, empowering both individuals and institutions.

This isn’t just theory, it’s already influencing capital flows across decentralized markets. As more projects integrate confidential smart contracts, expect a surge in enterprise adoption of DeFi tools once considered too transparent for institutional use cases.

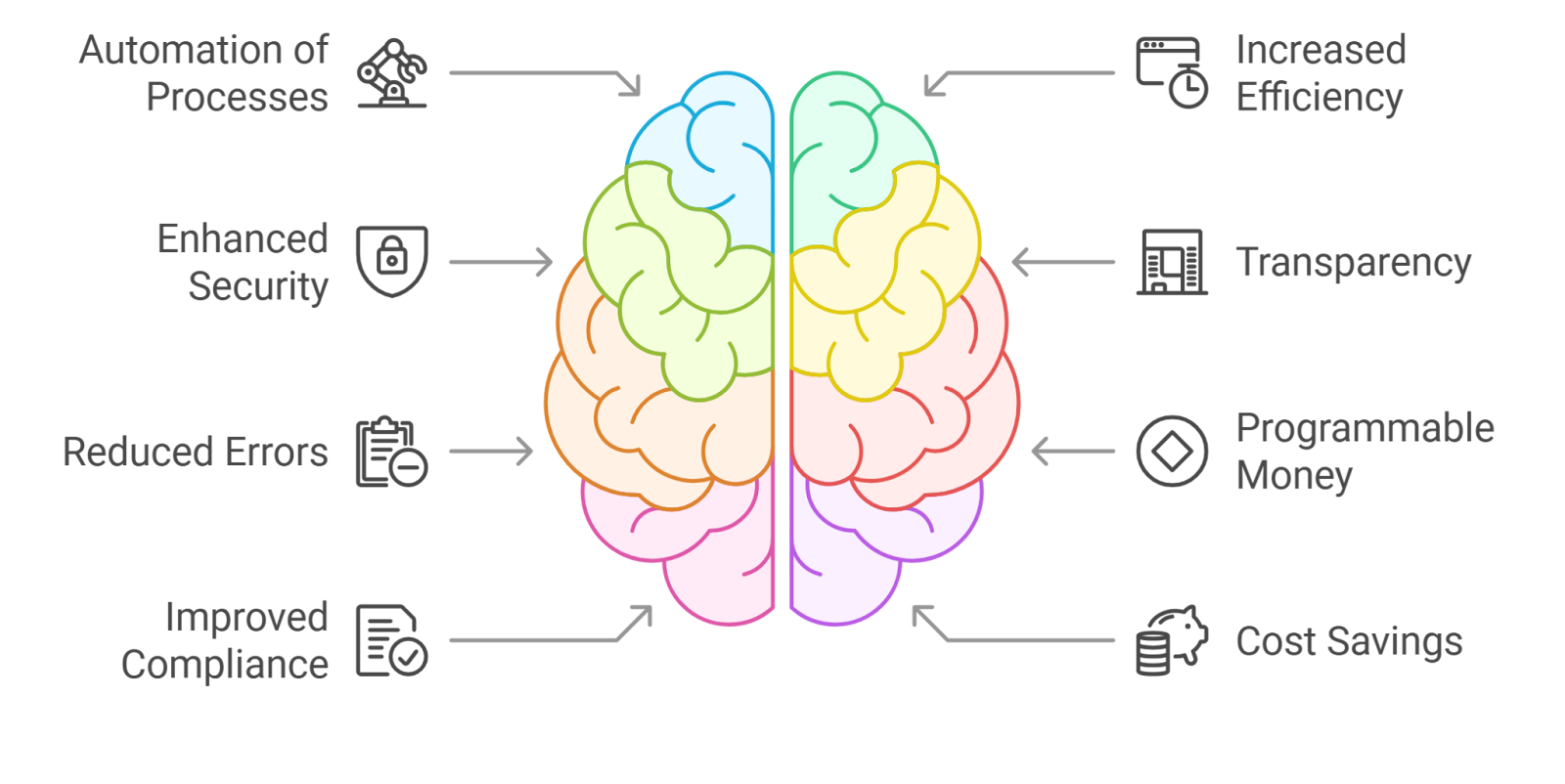

The Road Ahead: Unlocking Scalable Private DeFi Trading

The convergence of zero-knowledge proofs DeFi infrastructure, FHE in smart contracts, and robust MPC frameworks signals a new era for privacy protocols DeFi. The race is on to build scalable solutions that satisfy both user demand for confidentiality and regulator need for oversight, a delicate balance that will define the next generation of blockchain finance.

If you’re building or trading in this space, watch closely as encrypted perpetual DEXs move from niche experiments to liquidity powerhouses. The projects leading today are setting standards for tomorrow’s privacy compliance blockchain landscape, and those who adapt fastest will shape the rules of engagement for years to come.