Institutional adoption of blockchain technology is accelerating, but one stubborn barrier remains: privacy. Unlike retail users, institutions can’t afford to have every transaction detail broadcast to the world. Regulatory compliance demands transparency, yet business logic and sensitive data must stay confidential. This is the paradox that confidential smart contracts are engineered to solve.

Why Institutions Demand Confidential Blockchain Transactions

The open nature of traditional blockchains like Ethereum is a double-edged sword for enterprises. On one hand, transparency builds trust and enables auditability. On the other, it exposes competitive strategies, customer data, and trade secrets to rivals and the public. For financial institutions, healthcare providers, and supply chain operators alike, this level of exposure is a dealbreaker.

As Dusk Network bluntly puts it: without privacy, institutional adoption will remain out of reach. The industry needs solutions that deliver both institutional blockchain privacy and airtight regulatory compliance, no trade-offs allowed.

The Cryptographic Arsenal: How Confidential Smart Contracts Work

This new generation of smart contracts uses cutting-edge cryptography to keep sensitive information hidden while still allowing for validation and auditability. Here are the three pillars powering this evolution:

- Fully Homomorphic Encryption (FHE): FHE lets smart contracts process encrypted data directly, no decryption needed at any stage. Projects like Zama’s protocol enable Solidity developers to build confidential DeFi apps with familiar tools while ensuring end-to-end secrecy.

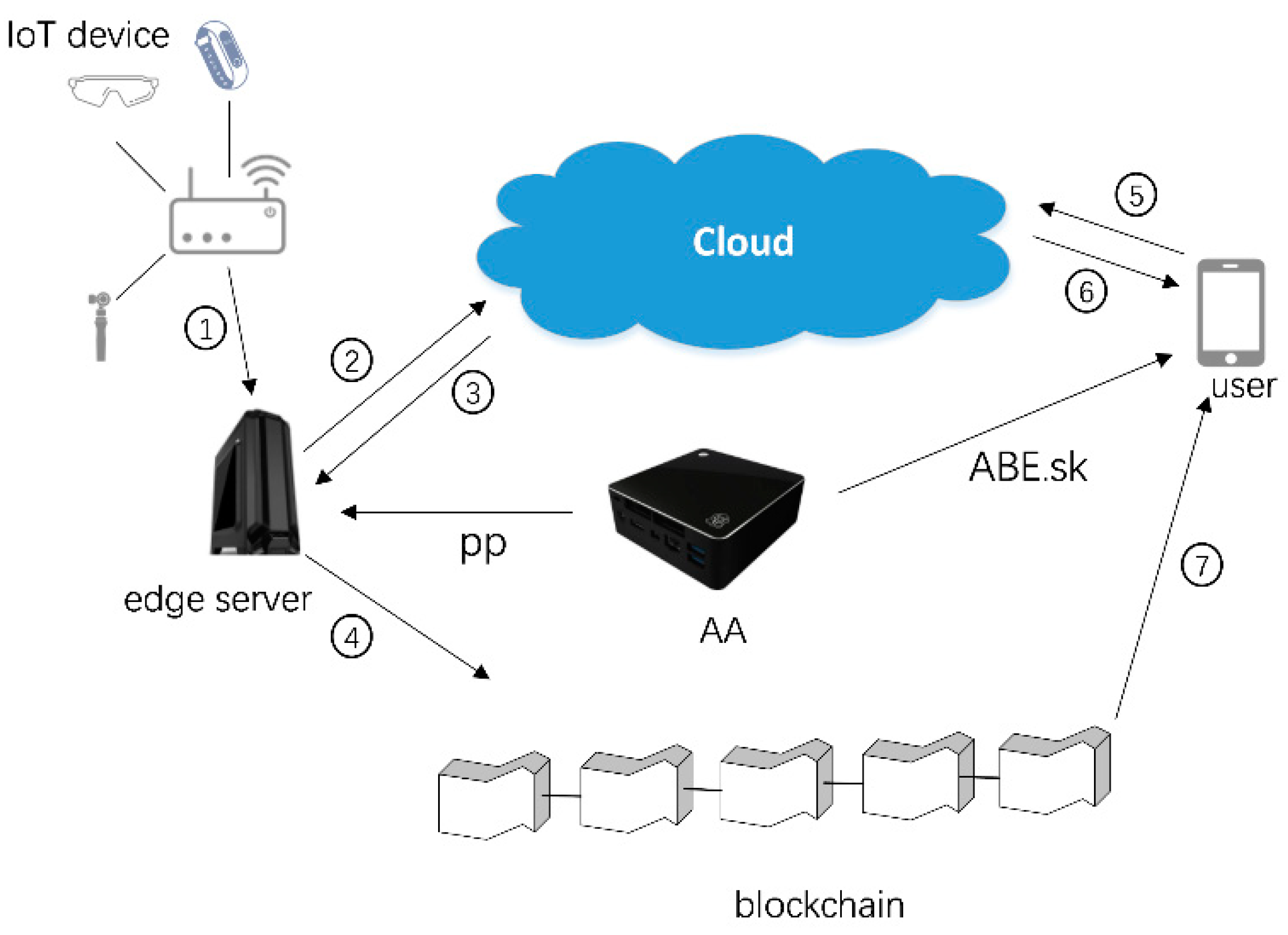

- Trusted Execution Environments (TEEs): TEEs provide hardware-based secure enclaves where contract code runs shielded from prying eyes, even those with system-level access can’t peek inside during execution.

- Zero-Knowledge Proofs (ZKPs): ZKPs empower one party to prove something about their data (like meeting a compliance check) without revealing the underlying details. This is the backbone for compliant privacy transactions in sectors where selective disclosure is paramount.

Together, these technologies form a robust shield against unauthorized access while preserving the integrity and verifiability regulators require.

Pioneering Real-World Applications: Privacy Meets Compliance

The impact isn’t theoretical, it’s transforming industries right now:

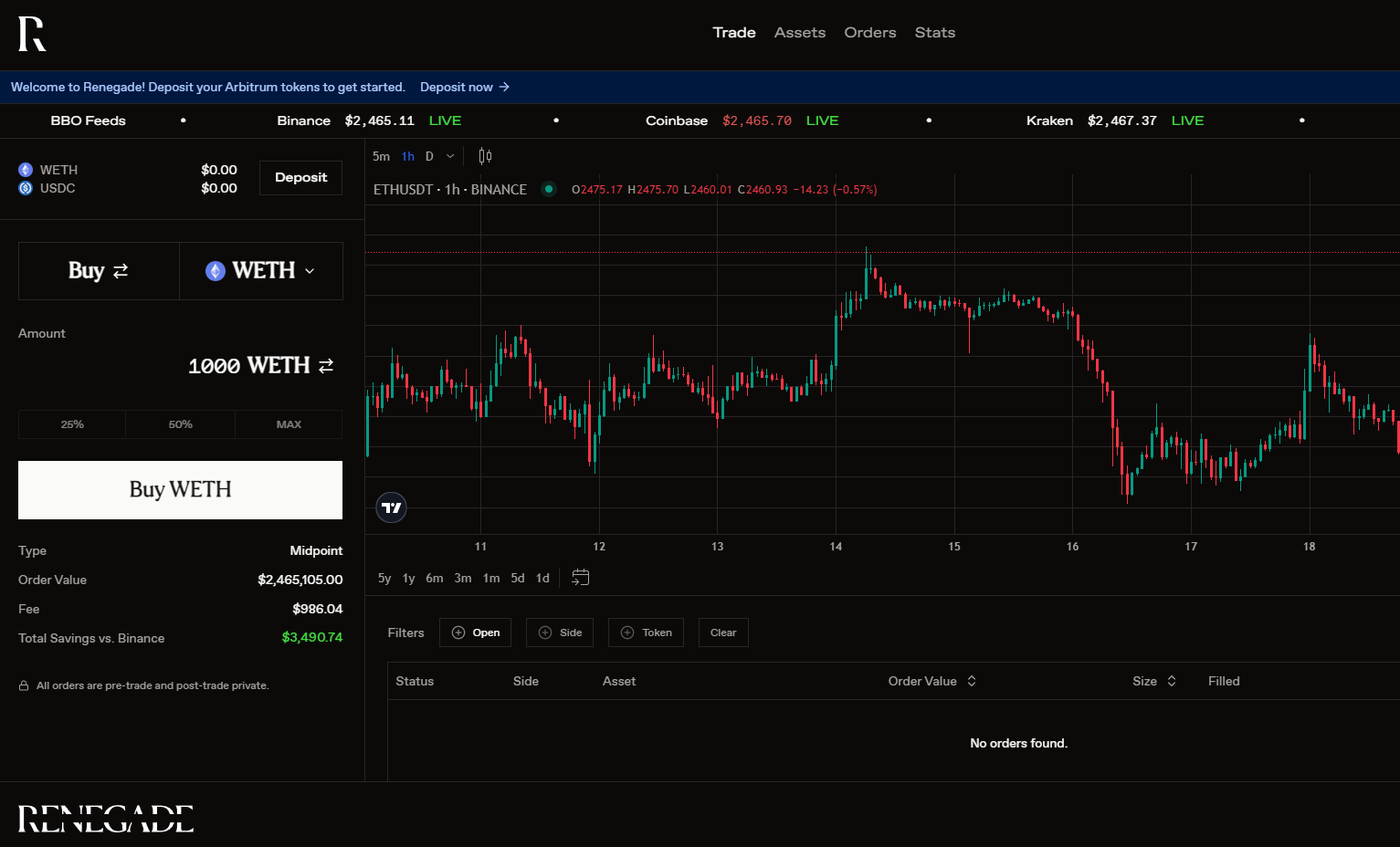

- Financial Services: Confidential trading desks can settle high-value transactions on-chain without leaking client positions or trade sizes. Private audits become possible with mechanisms for selective regulatory disclosure.

- Healthcare: Patient records can be managed on a distributed ledger with bulletproof privacy controls, unlocking interoperability while staying HIPAA-compliant.

- Supply Chain: Sensitive shipment details or supplier pricing can be tracked securely across borders without exposing proprietary information to competitors or bad actors.

If you want a deeper dive into how these mechanisms enable regulatory-compliant privacy on blockchain networks, check out our comprehensive resource at /how-confidential-smart-contracts-enable-regulatory-compliant-privacy-on-blockchain.

The Compliance-Privacy Balancing Act in Action

The real magic happens when privacy doesn’t come at the expense of auditability. Solutions like Chainlink’s Blockchain Privacy Manager allow institutions to operate private networks that only reveal transaction details when legally required, think selective windows into an otherwise sealed vault. Regulators get what they need; businesses keep their secrets intact.

What’s driving this leap forward is a new breed of enterprise blockchain privacy solutions that don’t just bolt on privacy as an afterthought. Instead, they embed cryptographic guarantees at the protocol level. This means institutions can automate compliance checks and reporting directly within confidential smart contracts, reducing manual overhead and risk of human error.

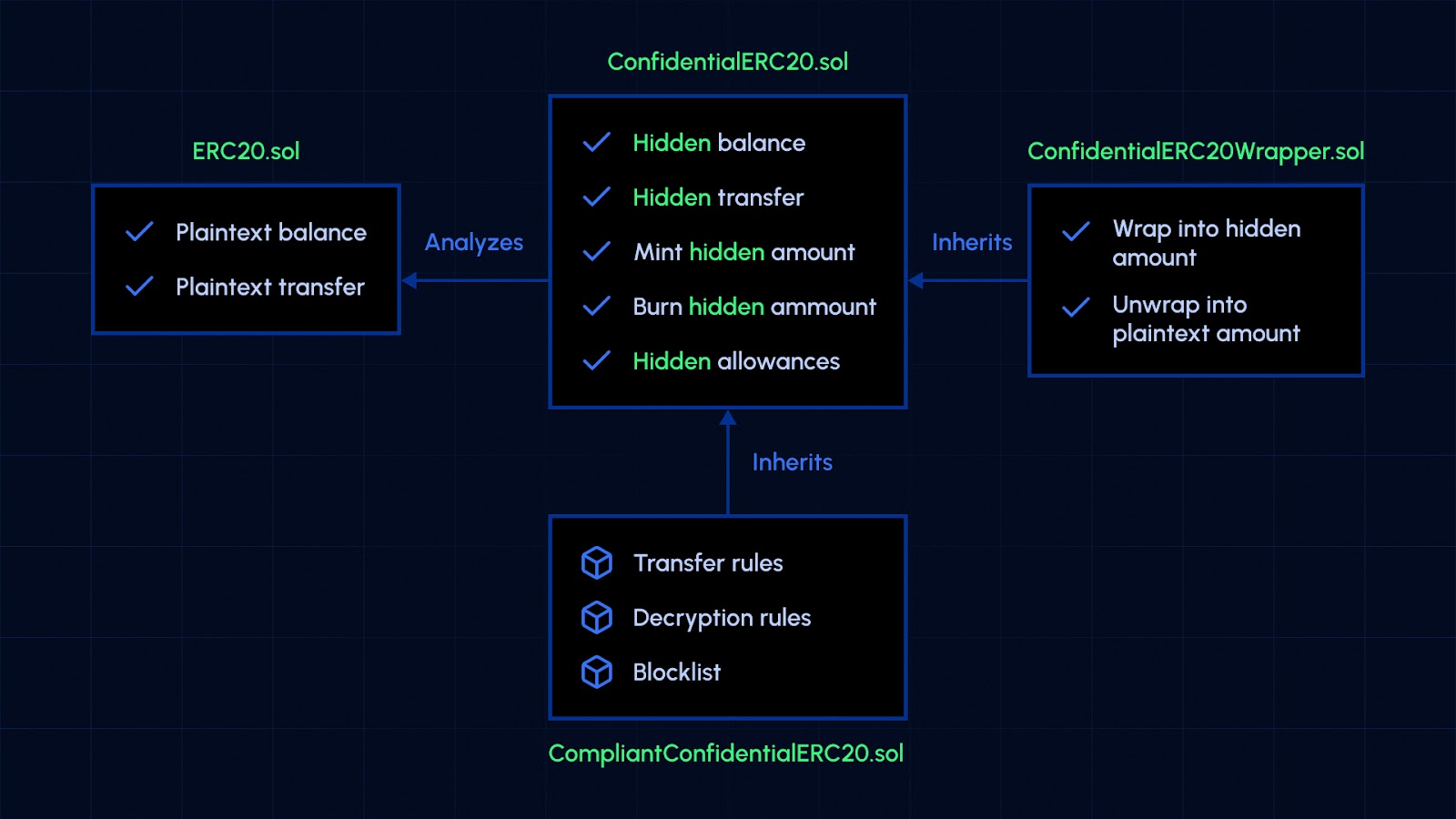

Consider the evolution of confidential ERC-20 tokens. By wrapping standard tokens in privacy-preserving layers, organizations can mask transaction amounts and balances, yet still provide cryptographically verifiable proofs to regulators when needed. This approach is already shaking up how private DeFi trading desks operate, letting them stay ahead without sacrificing oversight.

“Privacy is not the enemy of compliance, it’s the foundation of institutional trust on-chain. “

Auditability Without Exposure: The New Standard

The days of all-or-nothing transparency are numbered. With zero-knowledge proofs for compliance, institutions can now demonstrate adherence to AML/KYC laws or capital requirements without exposing underlying data. Imagine a bank proving its reserves or a healthcare provider validating patient consent, all without revealing sensitive details to competitors or hackers.

Powerful Use Cases for Confidential Smart Contracts

-

Private Institutional Trading & Settlements: Confidential smart contracts empower banks and asset managers to execute private trades, settlements, and compliance checks without exposing sensitive strategies or counterparties. Platforms like Chainlink’s Blockchain Privacy Manager enable selective disclosure for audits, balancing privacy with regulatory needs.

-

Secure Healthcare Data Management: Healthcare providers use confidential smart contracts to securely manage patient records, insurance claims, and medical research data. This ensures compliance with regulations like HIPAA while keeping sensitive health information private. Zama’s Confidential Blockchain Protocol enables encrypted data processing for healthcare applications.

-

Confidential Supply Chain Tracking: Enterprises leverage confidential smart contracts to track goods, verify provenance, and share sensitive supply chain data with trusted partners—without exposing trade secrets. Solutions like Chainlink CCIP facilitate private, auditable supply chain operations.

-

Compliant On-Chain Asset Issuance: Financial institutions can issue and manage confidential ERC-20 tokens that mask balances and transaction amounts, enabling privacy-preserving digital asset operations. Circle’s Confidential ERC-20 Framework is pioneering this approach for compliant, private tokenization.

-

Fair & Private Blockchain-Based Auctions: Confidential smart contracts enable sealed-bid auctions where bids remain private until the auction closes, ensuring fairness and preventing collusion. Protocols like Zama Protocol support confidential auction mechanisms for high-value assets.

This paradigm shift is also making waves in cross-border transactions. Supply chain operators are leveraging confidential smart contracts to share provenance data with customs authorities, while keeping supplier lists and pricing confidential from market rivals. The result? Frictionless trade and bulletproof audit trails.

How to Get Started: Onboarding Institutional Privacy

If you’re ready to future-proof your enterprise stack with compliant privacy, start by assessing which business processes demand both confidentiality and regulatory alignment. Then explore frameworks that support confidential computing (like TEEs) or FHE-based protocols that integrate with existing chains.

Developers should look for toolkits that offer seamless Solidity compatibility, think Zama Confidential Blockchain Protocol, or solutions that enable selective disclosure via zero-knowledge proofs. For those building private DeFi platforms, integrating confidential ERC-20 wrappers is a game changer for both user safety and institutional adoption.

Want hands-on guidance? Our step-by-step breakdown on how to implement encrypted smart contracts on Ethereum will accelerate your journey from pilot to production.

The Road Ahead: Privacy as the Gateway to Institutional Blockchain Growth

The message from the market is loud and clear: compliant privacy transactions are not a niche feature, they’re table stakes for serious institutional players. As regulatory scrutiny intensifies and cyber threats evolve, only those who master this balance will thrive.

The best part? The technology is here today, and it’s only getting more powerful. By embracing confidential smart contracts now, enterprises position themselves at the forefront of blockchain innovation while safeguarding what matters most: their reputation, their clients’ trust, and their competitive edge.