In the rapidly evolving DeFi ecosystem, confidential smart contracts are setting a new standard for privacy and market fairness. As Ethereum (ETH) holds steady at $4,475.36, the appetite for secure, private financial infrastructure is more intense than ever. Traditional DeFi order books and auctions are notorious for exposing sensitive transaction data, enabling front-running and undermining true price discovery. Confidential smart contracts are rewriting these rules by embedding advanced cryptography directly into the heart of decentralized protocols.

Why Public Order Books Undermine DeFi Integrity

Open order books have long been a double-edged sword in DeFi. While they promise transparency, they also broadcast every move to the world, making it trivial for bots and whales to exploit large orders or snipe pending transactions. This visibility fuels front-running, where malicious actors jump ahead of legitimate trades, and spoofing, where fake orders manipulate market sentiment.

Confidential order books flip this paradigm by encrypting each buy and sell order until execution. Platforms like Enclave Markets use secure enclave technology to keep every order sealed in a trusted environment, only revealing details once trades are finalized. This approach makes it impossible to game the system by peeking at live liquidity or outsized bids, restoring genuine price discovery and leveling the playing field.

The Mechanics Behind Private Sealed-Bid Auctions

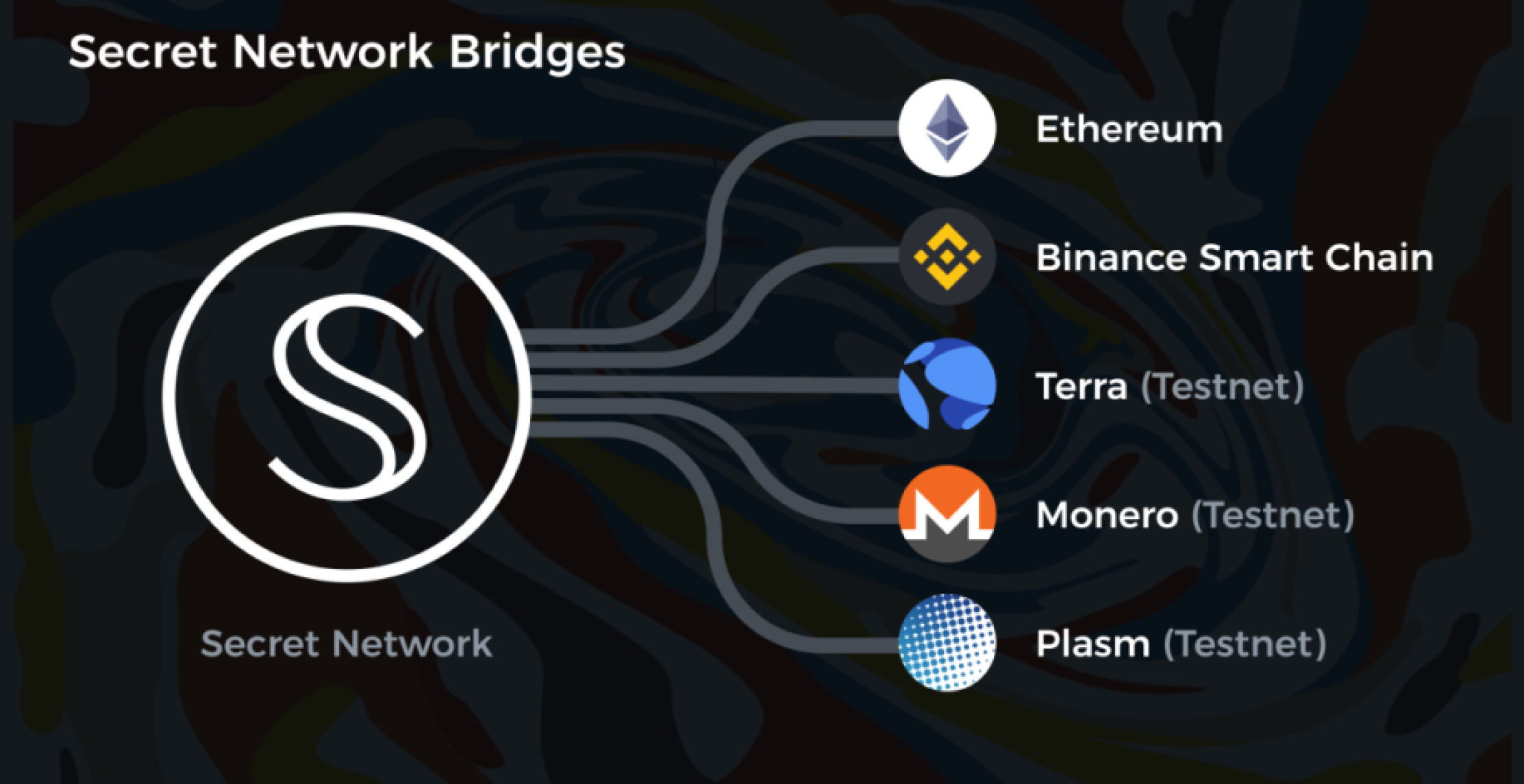

Sealed-bid auctions on blockchain are another area where privacy is paramount. In these formats, all bids remain hidden until the auction ends, preventing participants from reacting to each other’s offers. The Secret Network’s confidential auction contract is a prime example, enabling cross-chain private bidding where both amounts and bidder identities stay encrypted until final settlement (source). This confidentiality ensures that auctions aren’t skewed by late-stage bid manipulation or collusion.

The technical backbone of these systems involves:

Key Technologies Behind Confidential DeFi Smart Contracts

-

Trusted Execution Environments (TEEs): Secure enclaves like Intel SGX enable confidential execution of smart contracts, isolating sensitive data from the rest of the system. TEEs are foundational for platforms such as Enclave Markets, which leverage this technology for private order books.

-

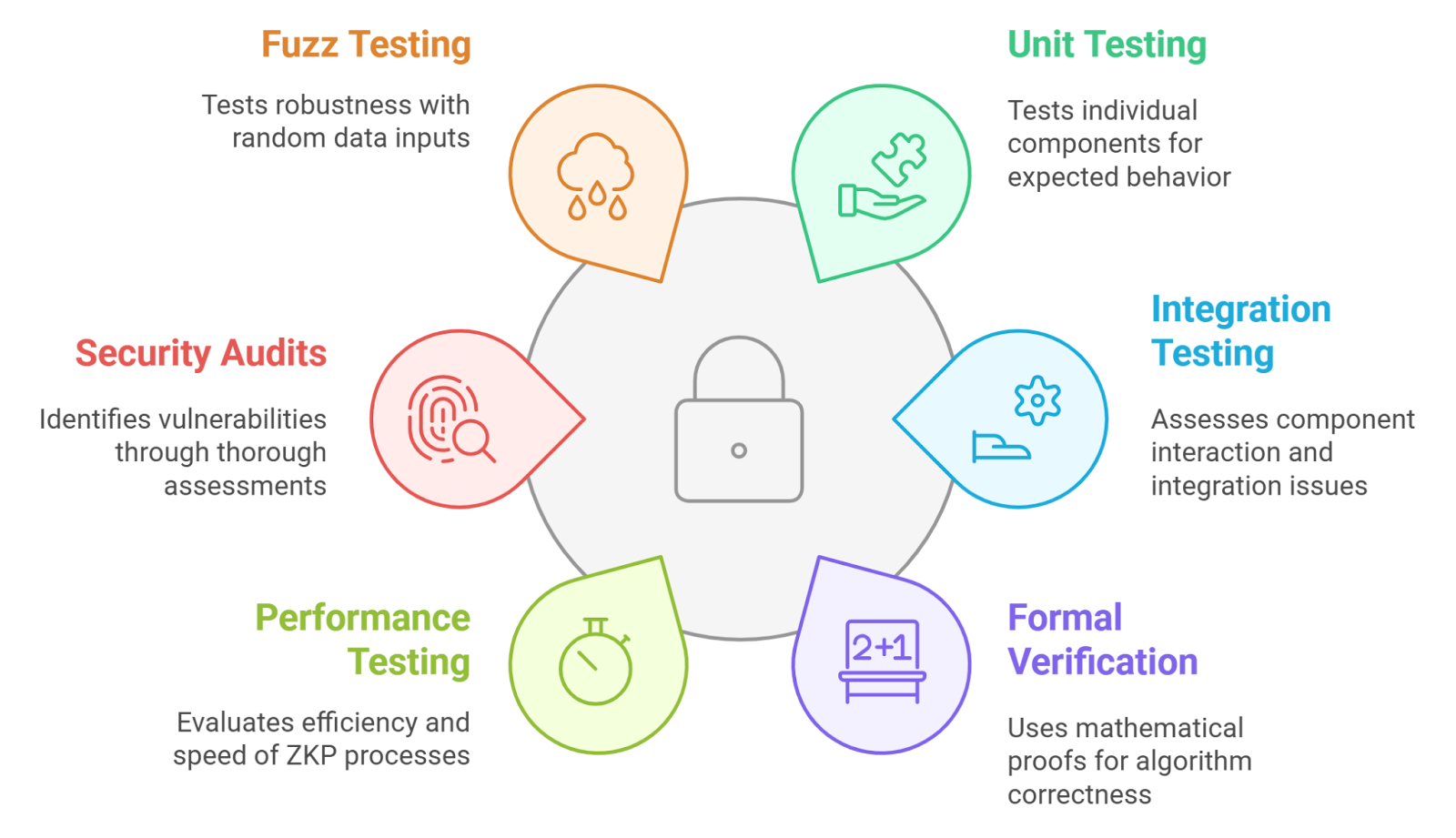

Zero-Knowledge Proofs (ZKPs): Advanced cryptographic protocols, including zk-SNARKs and zk-STARKs, allow verification of transactions without revealing underlying data. Leading DeFi privacy projects like Aztec Network and Secret Network use ZKPs for confidential contract execution.

-

Fully Homomorphic Encryption (FHE): FHE enables computation on encrypted data, maintaining privacy throughout processing. The Zama Protocol and its fhEVM are pioneering confidential smart contracts and sealed-bid auctions using FHE on Ethereum and other chains.

-

Confidential Blockchain Protocols: Protocols like Secret Network and Zama Confidential Blockchain provide infrastructure for confidential smart contracts, supporting private DeFi order books and sealed-bid auctions across multiple blockchains.

-

Privacy-Preserving Auction Designs: Implementations such as Secret Network’s sealed-bid auction contract and ZeroAuction use cryptographic methods to keep bids and participant identities hidden until auction completion, ensuring fair and private DeFi auctions.

This fusion of cryptographic primitives ensures that even as transactions are validated on-chain, no party gains access to sensitive information before it’s meant to be revealed.

The Technology Stack: TEE, ZKP and FHE Explained Visually

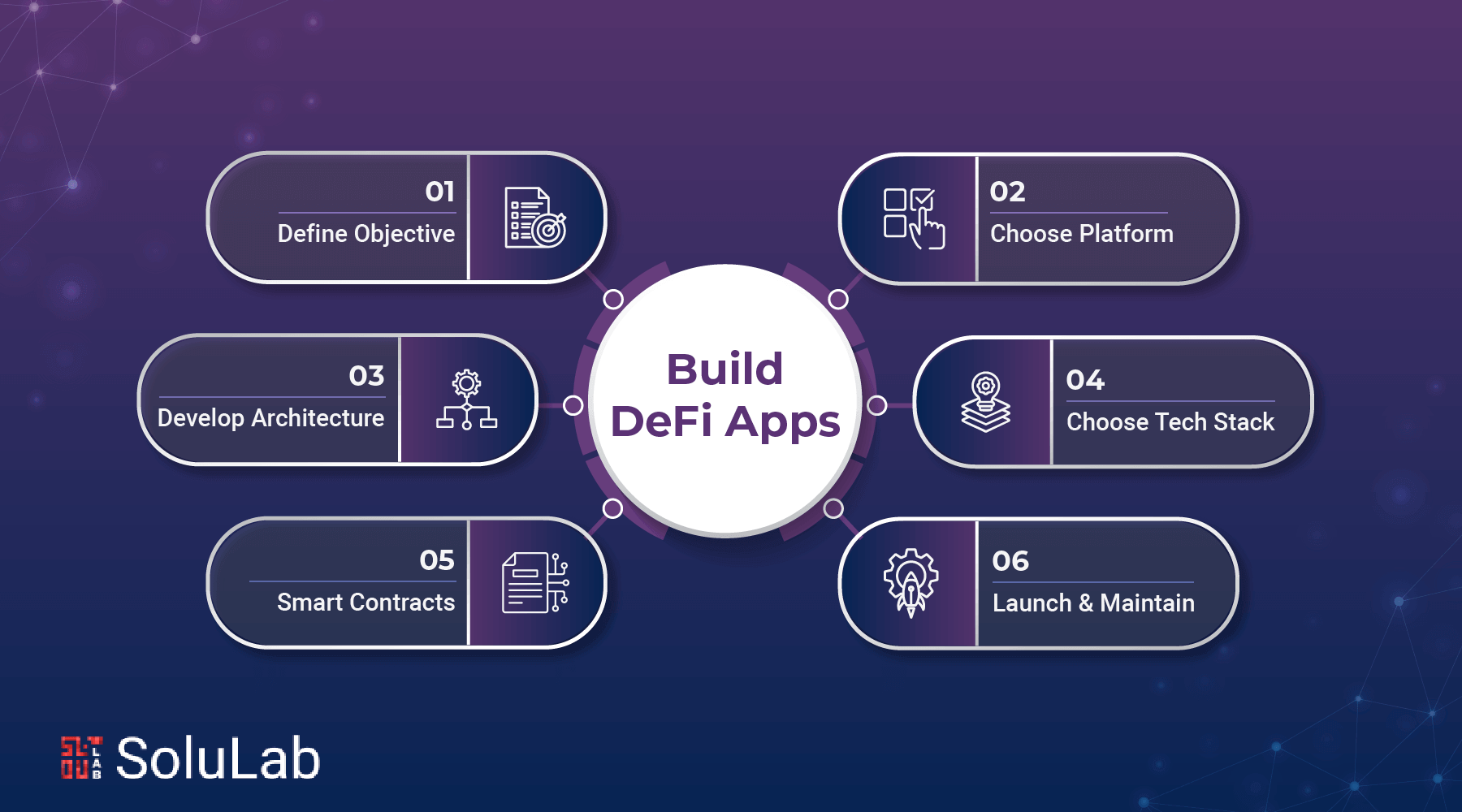

The rise of FHE smart contracts, MPC blockchain privacy, and ZK DeFi applications has unlocked new ways to achieve robust confidentiality without compromising composability or trustlessness:

- Trusted Execution Environments (TEE): Hardware-based enclaves like Intel SGX isolate contract logic from external observation (source). TEEs power projects such as Enclave Markets’ private order books.

- Zero-Knowledge Proofs (ZKP): Allow validation of transaction correctness without revealing underlying values, crucial for proving honest auction outcomes or verifying encrypted lending pool balances (source).

- Fully Homomorphic Encryption (FHE): Enables computation on encrypted data itself; Zama’s fhEVM lets developers build Solidity confidential contracts that keep bid values secret even during on-chain processing (source).

This trifecta empowers developers to design privacy preserving DeFi protocols that don’t just hide data, they make exploitation mathematically infeasible.

As confidential smart contracts mature, their impact on private DeFi order books and sealed-bid auctions blockchain is unmistakable. The fusion of TEE, ZKP, and FHE has moved beyond theory and into production-grade deployments, with platforms like Zama’s Protocol enabling confidential contracts atop any L1 or L2. This flexibility means that privacy is no longer siloed to niche chains, it can be layered onto Ethereum mainnet or rollups without sacrificing composability or UX.

Real-World Applications: From Trading to Encrypted Lending Pools

The practical benefits are already visible across DeFi verticals:

- Private Order Matching: Confidential order books enable fairer markets by hiding liquidity depth and trade intent until execution. This is crucial for institutional traders seeking to reduce information leakage.

- Sealed-Bid Auctions: Projects are leveraging Zama’s fhEVM and Secret Network’s IBC contracts to run single-price token sales where bids remain hidden until settlement, eliminating last-second sniping and collusion.

- Encrypted Lending Pools: Borrowers and lenders can interact without exposing positions or risk profiles, unlocking new forms of undercollateralized lending while preserving privacy.

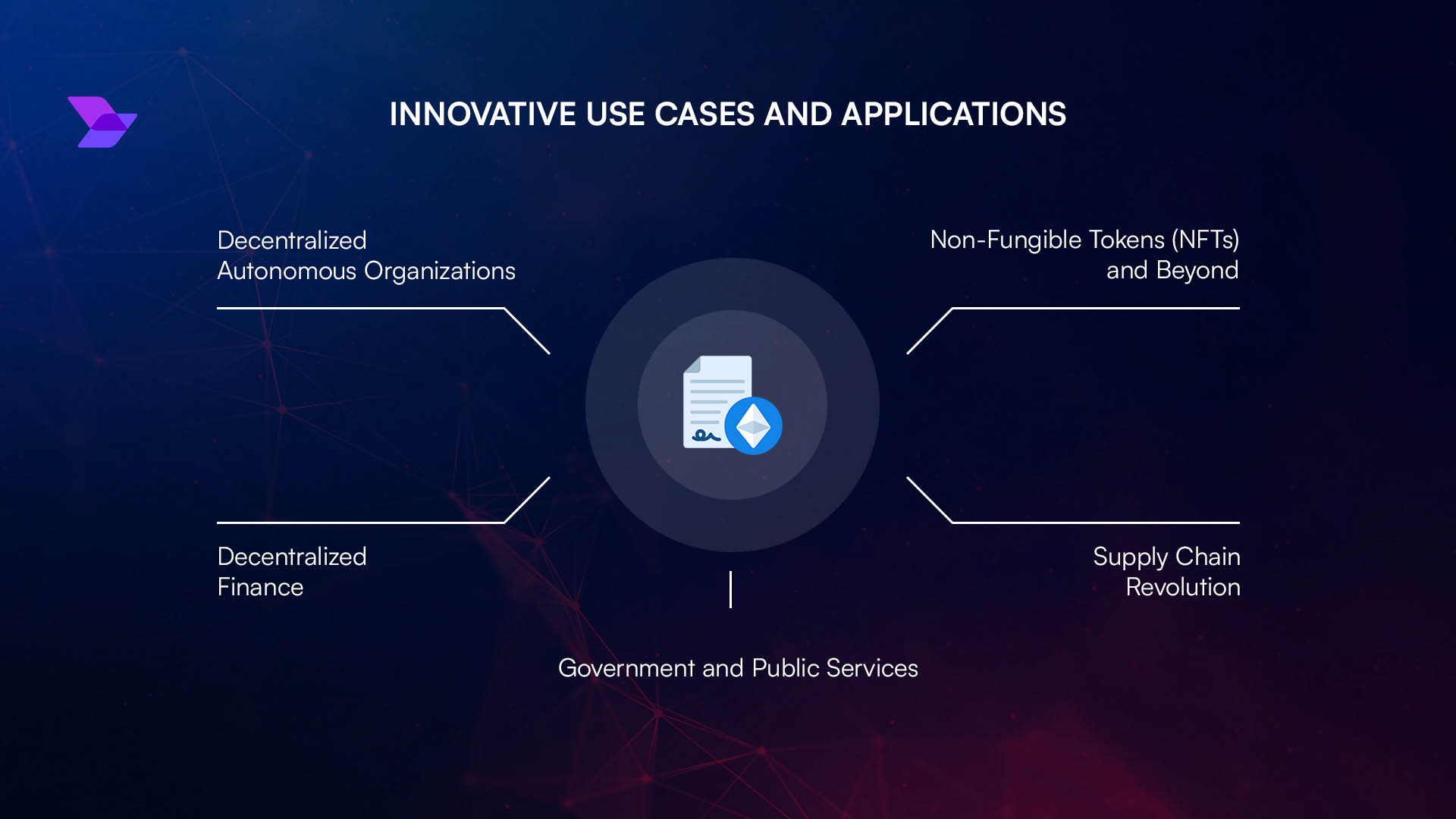

This innovation isn’t limited to financial primitives. Confidential smart contracts also underpin confidential voting systems, private DAOs, and secure data marketplaces, proving their versatility across web3 use cases (source).

Challenges Ahead: Gas Costs, Audits and Adoption

No technology is without trade-offs. While confidentiality brings powerful protections, it introduces complexity in both development and auditing. FHE operations remain computationally intensive, though ongoing research is rapidly improving efficiency (source). Secure enclave implementations must be rigorously audited to avoid side-channel leaks. Finally, user education is critical, traders must trust that their encrypted bids or orders are truly private until execution.

The bottom line: The demand for privacy preserving DeFi solutions will only intensify as on-chain volumes grow and Ethereum trades at $4,475.36. Confidential smart contracts are not a luxury, they’re becoming a necessity for market integrity in the era of public ledgers.

Top Advantages of Confidential Smart Contracts in DeFi

-

Enhanced Transaction Privacy: Confidential smart contracts conceal sensitive order and bid details, protecting user data and trading strategies from public exposure. Platforms like Enclave Markets use secure enclaves to ensure order confidentiality until execution.

-

Prevention of Front-Running and Market Manipulation: By hiding order books and bids until execution, confidential smart contracts reduce risks of front-running and spoofing, promoting fairer trading environments across DeFi platforms.

-

Private and Fair Auctions: Solutions like Secret Network’s sealed-bid auction contracts enable private bidding where participant identities and bid amounts remain confidential until auction close.

-

Advanced Cryptographic Security: Technologies such as Trusted Execution Environments (TEEs), Zero-Knowledge Proofs (ZKPs), and Fully Homomorphic Encryption (FHE)—as seen in Zama’s fhEVM—ensure data remains private even during contract execution.

-

Broader DeFi Innovation: Confidential smart contracts unlock new use cases, including private lending, confidential voting, and secure data marketplaces, expanding the possibilities for decentralized finance.

The next wave of adoption will likely hinge on seamless developer tooling (like Solidity confidential contracts), standardized audit frameworks, and further reductions in the gas costs associated with cryptographic operations.

Visualizing the Future: Private DeFi at Scale

The vision is clear: a permissionless financial system where sensitive strategies remain protected by default, yet every transaction remains verifiable by code. With innovations like Zama’s fhEVM powering on-chain sealed-bid auctions (source) and TEEs isolating order flow data, DeFi can finally shed its reputation as a playground for predatory bots.

This paradigm shift won’t happen overnight but it’s already underway, one encrypted contract at a time. For developers building tomorrow’s protocols or institutions seeking safe access to crypto markets at current price levels like $4,475.36, confidential smart contracts aren’t just an upgrade, they’re essential infrastructure for the next era of open finance.